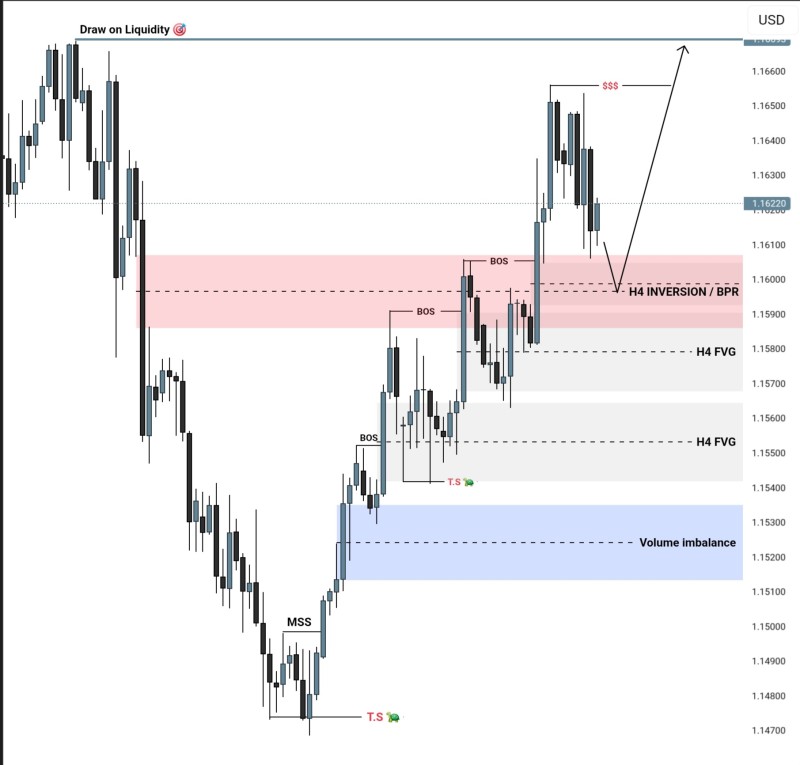

EUR/USD is displaying a textbook bullish formation on the H4 timeframe, backed by clear break-of-structure confirmations and well-defined demand areas. The current chart pattern suggests the pair is simply retracing into a crucial support level before pushing higher toward the previous weekly high. This combination of structure, liquidity positioning, and clean order flow makes further upside the most probable outcome.

EUR/USD H4 Outlook Strengthens as Demand Zones Hold

The bullish narrative stays valid as long as EUR/USD keeps respecting the higher timeframe inversion zone. The chart shows the broader trend flipped upward after a market structure shift near 1.1480. From there, the pair built a series of Break of Structure points, each one confirming growing upward momentum.

The rally kicked off from a substantial volume imbalance zone between 1.1500 and 1.1530, which provided solid demand support. Since then, EUR/USD has created several H4 fair value gaps on its way up—these gaps represent price inefficiencies that markets often revisit during normal pullbacks, which is exactly what we're seeing now.

Key Technical Zones: H4 Inversion Block and Liquidity Map

The most critical zone sits around 1.1580-1.1600—this H4 inversion/breaker block was previously a supply area, but price broke above it and turned it into bullish demand. The current pullback seems headed straight into that zone, and how price reacts here will likely determine the next move up.

Other important observations from the chart:

- Liquidity Draw: There's a clear pool of liquidity sitting above recent highs near 1.1650+, naturally attracting price higher

- Bulls in Control: The latest lower-timeframe pullback hasn't broken any major bullish structure, keeping the upward sequence intact

- Healthy Retracement: The decline is orderly and lines up with the expected revisit of the H4 inversion zone—this isn't a reversal

- FVG Alignment: The unfilled fair value gaps below current price provide additional technical support for continued bullish movement

These chart signals completely align with the bullish outlook and strengthen the case for a move toward the Previous Weekly High.

Macro Drivers Supporting EUR/USD Strength

Current fundamentals back up the bullish technical picture. We're seeing softer U.S. dollar momentum as inflation expectations ease, more stable Eurozone macro data compared to earlier in the year, market appetite shifting toward risk assets (weakening USD demand), and expectations building for a more dovish Federal Reserve stance. When you combine these factors with the clean H4 structure, the upside case gets even stronger.

EUR/USD Maintains Bullish Structure Toward PWH

EUR/USD's H4 chart shows a well-organized bullish environment, with price pulling back into a high-value demand zone before what looks like another leg higher. As long as the pair holds above 1.1580-1.1600, the path toward the Previous Weekly High remains the dominant scenario. Traders should watch how price reacts inside this inversion/breaker zone—a solid bounce from here would confirm the next move up, continuing the clean bullish progression we've been seeing.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir