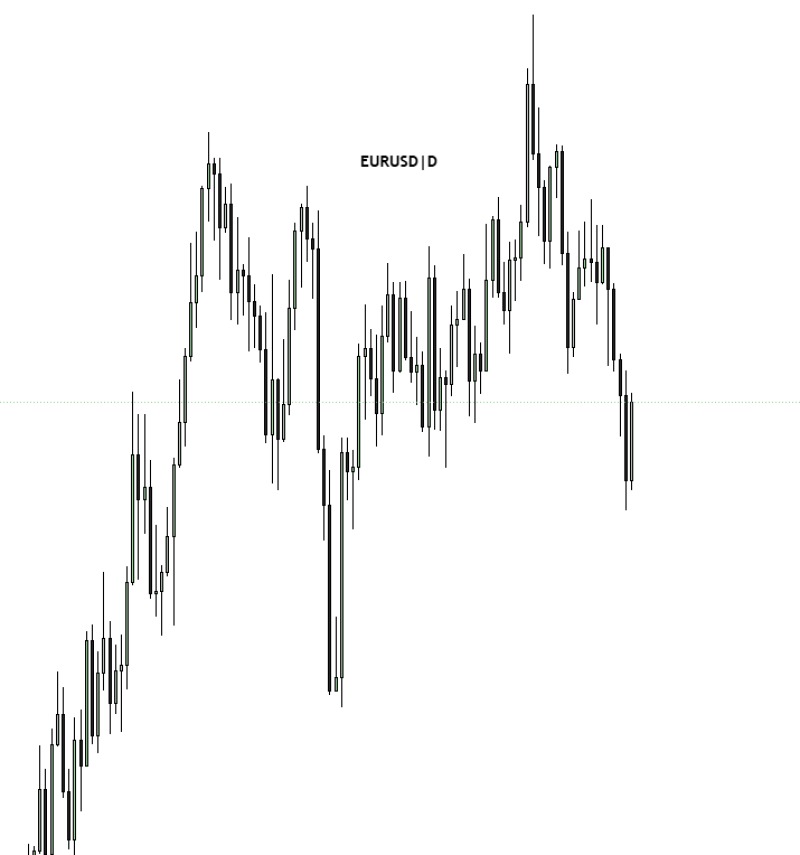

The EUR/USD pair has reached a pivotal moment as technical indicators point to fading bullish strength. Recent price action on the daily timeframe shows mounting downside momentum, raising concerns about whether the euro can maintain its footing against the greenback or succumb to a deeper pullback. The chart setup reflects a shifting power dynamic between bulls and bears in forex's most actively traded pair.

EUR/USD Daily Chart Analysis

Market analyst Lemayian flagged this developing chart pattern, which reveals several critical elements at play. The pair is printing lower highs and lower lows - a textbook sign of eroding bullish conviction.

Price action is now testing a meaningful support band near 1.06–1.07, an area where buyers have historically regrouped. Meanwhile, recovery attempts repeatedly stall at 1.10–1.11, where sellers remain entrenched. Extended candlestick wicks point to heightened volatility and market sensitivity to headline risk, suggesting the technical picture remains fragile and prone to further weakness unless bulls can reclaim control at these pivotal levels.

Macro Drivers Behind the Move

The recent slide isn't happening in a vacuum. A hawkish Federal Reserve stance - with fewer anticipated rate cuts in 2025 - continues to underpin dollar strength. At the same time, lackluster growth figures out of the Eurozone keep the euro on its back foot. Add to that a risk-off tone driven by geopolitical uncertainty, and you've got a perfect storm for greenback demand. These fundamental crosscurrents are amplifying the bearish tone visible on the charts.

What's Next for EUR/USD?

If EUR/USD holds the 1.06 zone firm, a technical bounce toward 1.09–1.10 remains in play. But a clean break below support could unlock a steeper descent, potentially eyeing 1.03 or - in a worst-case scenario - a return to parity. Traders should watch central bank commentary and upcoming data releases closely, as both will likely dictate near-term direction. The daily chart suggests downside risks are building, and EUR/USD volatility is likely to persist as markets digest evolving Fed policy expectations and Eurozone economic realities.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir