● Commodity Trading Advisors are getting more bullish on the greenback, according to a recent post from Menthor Q. The numbers tell a clear story: systematic funds are loading up on USD longs while backing away from the euro, yen, and pound. It's classic defensive positioning in a market that's feeling jittery about uneven growth and central banks moving in different directions.

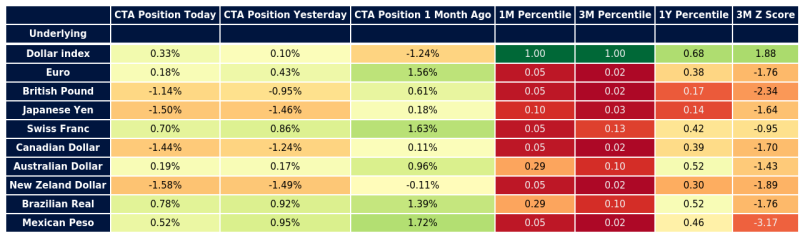

● CTA positioning in the Dollar Index jumped from 0.10% to 0.33%, while the euro (-1.38%), yen (-1.68%), and pound (-1.75%) all took hits over the past month. That's a textbook flight to safety—traders want the dollar as a buffer against economic and geopolitical noise.

● This dollar strength squeeze is doing two things: tightening financial conditions globally and putting pressure on riskier currencies, especially in emerging markets and commodity-linked economies. The Aussie and Canadian dollars are holding relatively steady but staying quiet as investors avoid anything too cyclical. The Kiwi, meanwhile, keeps lagging—nobody wants high-beta currencies right now.

● What's driving this? The Fed's still holding a hawkish line while other major central banks are loosening up. As rate cut expectations fade, the dollar keeps its yield edge over both developed and emerging market currencies.

● As Menthor Q put it: "CTAs are adding to USD longs while cutting exposure to the euro, yen, and pound"—defensive dollar positioning is running the show in FX right now.

● The 3-month Z-score for the Dollar Index sits at +1.88, showing strong momentum behind long-dollar trades. The euro's at -1.76 and the Mexican peso's at -3.17—both at extreme lows, underlining just how wide the gap has become across global currency markets.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi