The Aussie dollar (AUD/USD) is having a pretty decent run against the greenback, punching through that key 0.6500 resistance level while central banks keep everyone on their toes with policy shifts and mixed signals from major economies.

AUD/USD Keeps Climbing Despite Traders' Doubts

The Australian dollar managed to claw back some ground on Tuesday, getting a boost from all the back-and-forth action we're seeing with the US dollar. AUD/USD basically picked up where it left off from Monday's positive vibes, breaking above that stubborn 0.6500 barrier and now sitting pretty close to those yearly highs around 0.6540 we saw back in mid-May.

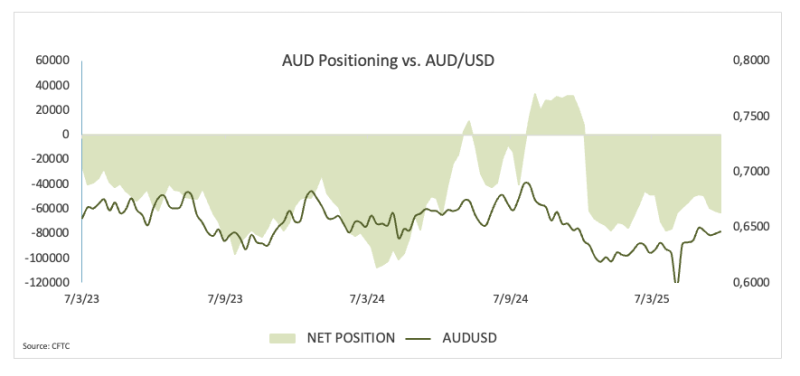

What's interesting is this climb is happening even though most folks aren't exactly bullish on the Aussie right now. The latest CFTC data tells the story - net short positions jumped to multi-week highs of around 63.2K contracts in the week ending June 3. With open interest on the rise too, it's clear that traders are still betting against this currency pair for the long haul.

How Central Banks Are Moving AUD/USD Around

Currency markets are basically glued to whatever central bankers are saying these days, with traders hanging on every word to figure out where interest rates might be heading next. The Fed decided to sit tight at their May meeting, with Jerome Powell sticking to his "we'll see what the data says" approach. But here's the thing - April's inflation numbers came in softer than expected, and we've been seeing some weaker economic data across the board. That's got markets thinking we might actually see a rate cut by September.

Over in Australia, the Reserve Bank did exactly what everyone expected and chopped rates by 25 basis points, bringing them down to 3.85%. The RBA's playing it pretty cautious though, suggesting rates could drop all the way to 3.2% by 2027. They're forecasting inflation will cool off to 2.6% while GDP growth slows to 2.1% in 2025.

Reading through the meeting minutes, it's clear the RBA wants to keep things predictable in what's been a pretty wild global environment. But they're keeping their options open - if people stop spending or wages start stagnating because the job market gets rough, they might cut rates more aggressively. Right now, markets are putting nearly 80% odds on another 25-point cut as soon as July, with close to 100 basis points of cuts priced in by the end of 2026.

China's Economic Mess Is Giving AUD/USD Traders Headaches

Australia's biggest trading partner, China, is sending some seriously mixed signals that are making life complicated for AUD/USD. Sure, their first-quarter industrial production numbers looked decent and beat expectations, but retail sales were pretty underwhelming and investment spending was just lukewarm at best - classic signs that things aren't as rosy as they could be.

The People's Bank of China tried to give their economy a nudge by cutting both their one-year and five-year Loan Prime Rates to 3.00% and 3.50% respectively. But then May's Caixin Manufacturing PMI dropped to 48.3, which means it's deeper in contraction territory - not exactly what you want to see if you're hoping for a strong comeback. And to make matters worse, the latest inflation data shows China's still stuck in deflation mode, with June's headline CPI actually falling 0.1% year-over-year.

From a technical standpoint, AUD/USD is bumping up against some pretty important resistance at that 2025 high of 0.6537 from May 26. If it manages to break through there, we could see it test the November 2024 peak at 0.6687, and if the stars align, maybe even that 2024 high of 0.6942. On the flip side, if things go south, there's support sitting at 0.6356 from May 12, backed up by the 55-day moving average at 0.6375. If it drops further, the 100-day moving average at 0.6339 should provide some cushion, with that psychological 0.6000 level and the April 9 low of 0.5913 as deeper support zones.

The momentum indicators are actually looking pretty good right now. The Average Directional Index is trending higher above 25, which suggests we've got a moderately strong trend going. Plus, the RSI has bounced back above 59, hinting that AUD/USD might have more room to run in the short term.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah