- AUD/USD Takes a Breather After Touching 0.6540 Six-Month High

- Dollar Index (DXY) Bounces Back from Monthly Lows Near 98.70

- Trump's EU Tariff Flip-Flop Leaves USD Looking Shaky

- Massive $3.8 Trillion Debt Bomb Has USD Investors Sweating

- Aussie Shines While Waiting for Wednesday's Inflation Reality Check

The AUD/USD currency pair gave up some gains after hitting a fresh six-month peak near 0.6540, though the Aussie still holds a 0.35% gain around 0.6500 as Dollar (USD) weakness persists amid policy uncertainty.

AUD/USD Takes a Breather After Touching 0.6540 Six-Month High

The AUD/USD pair couldn't hold onto its momentum on Monday after briefly kissing that sweet six-month high near 0.6540 earlier in the session. While it's given back some of those juicy gains, the Aussie's still sitting pretty with a 0.35% bump, hanging around the 0.6500 mark as traders seem fairly content with the overall vibe.

This pullback isn't exactly shocking – when you've had a run like the Aussie's been on, it's pretty normal to see some profit-taking when you hit fresh highs. Most chart watchers aren't too worried about this little step back, calling it more of a healthy breather than any kind of major trend reversal.

The big question now is whether AUD/USD can hold its ground above that 0.6480-0.6500 support zone. If it can stick around these levels, we might see another push higher. But if it starts slipping below, things could get interesting pretty quick.

Dollar Index (DXY) Bounces Back from Monthly Lows Near 98.70

The US Dollar Index managed to claw its way back from some pretty ugly lows around 98.70 earlier today, scrambling back up toward the 99.00 level like it's trying to prove it's not completely done for. The DXY's been getting beaten up lately, so any kind of bounce is probably welcome news for Dollar bulls.

But let's be real here – this recovery feels more like a dead cat bounce than any kind of meaningful turnaround. The Dollar's been struggling big time lately, and one decent day doesn't erase all the concerns that have been piling up. Traders are still pretty skeptical about whether the Greenback can get its act together.

The fact that the DXY is barely managing to stay above 99.00 tells you everything you need to know about how fragile this recovery really is. Until we see some sustained buying interest and a break above key resistance levels, this looks more like a temporary reprieve than the start of a genuine comeback.

Trump's EU Tariff Flip-Flop Leaves USD Looking Shaky

Well, this is awkward. President Trump just pulled a complete 180 on those brutal 50% tariffs he was threatening to slap on the EU, apparently after a cozy phone chat with European Commission President Ursula Von der Leyen. Talk about mixed signals – one day you're threatening trade war, the next you're backing down after a friendly conversation.

This kind of policy ping-ponging is exactly what makes investors nervous about holding Dollars. When you can't predict what the administration's going to do from one week to the next, it's pretty hard to feel confident about parking your money in USD. Consistency matters in currency markets, and right now, that's exactly what we're not getting.

The whole situation just reinforces this growing sense that the Dollar's losing its mojo as the world's go-to safe haven. When your own policy makers are this unpredictable, it's tough to convince international investors that your currency is the place to hide when things get scary.

Massive $3.8 Trillion Debt Bomb Has USD Investors Sweating

If the tariff flip-flopping wasn't enough to worry about, now we've got Trump pushing through legislation that could add a mind-blowing $3.8 trillion to the national debt over the next decade. Yeah, you read that right – trillion with a T. That's the kind of number that makes even the most optimistic fiscal hawks break out in a cold sweat.

This isn't just some minor budget increase we're talking about here. We're looking at one of the biggest potential debt expansions in US history, coming at a time when the country's already drowning in red ink. Credit rating agencies have been making nervous noises about US fiscal health for a while now, and this latest bombshell isn't exactly going to calm their nerves.

The market's starting to price in some serious long-term consequences for this kind of reckless spending. When you're already questioning the Dollar's safe-haven status and then you pile on concerns about whether America can actually pay its bills down the road, it's not exactly a recipe for currency strength.

Aussie Shines While Waiting for Wednesday's Inflation Reality Check

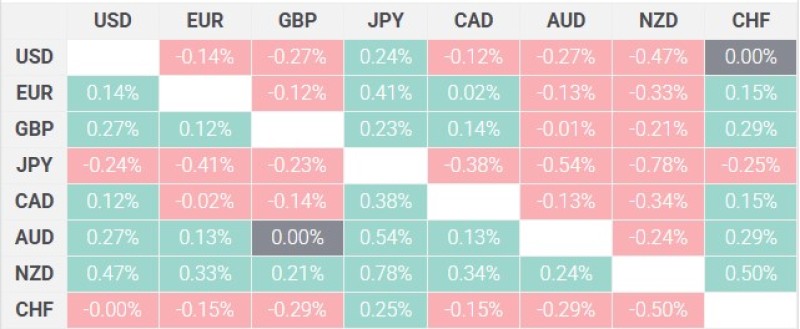

The Australian Dollar's been having a pretty solid run lately, outperforming almost everyone except its Kiwi cousin as risk appetite makes a comeback. Trump's decision to back down on those EU tariffs has definitely helped the mood, giving risk-sensitive currencies like the AUD a nice little boost.

Australia's looking pretty good compared to a lot of other developed economies right now. While other countries are dealing with political drama and economic uncertainty, the Aussie's got that steady-as-she-goes thing working for it, plus all those juicy commodity exports that keep the money flowing in.

But here's where things get interesting – Wednesday's CPI data could throw a wrench in the works. Everyone's expecting inflation to cool down to 2.3% from March's 2.4%, which sounds nice and moderate. Problem is, if inflation keeps sliding, it might give the Reserve Bank of Australia more reason to start cutting rates again, and that could take some of the wind out of the Aussie's sails. So while things look pretty rosy right now, Wednesday's numbers could change the whole game plan pretty quick.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah