AUD/JPY climbs towards 98.80 as positive Chinese PMI figures boost market sentiment.

China's PMI Boosts AUD/JPY

AUD/JPY inches higher to nearly 98.80 amidst encouraging Chinese PMI data, reflecting the close economic ties between Australia and China.

The Japanese Yen faces downward pressure as investor confidence strengthens with China reporting its first expansion in manufacturing activity in six months, with the Caixin Manufacturing PMI surpassing expectations at 51.1.

Chinese Manufacturing Activity Surges

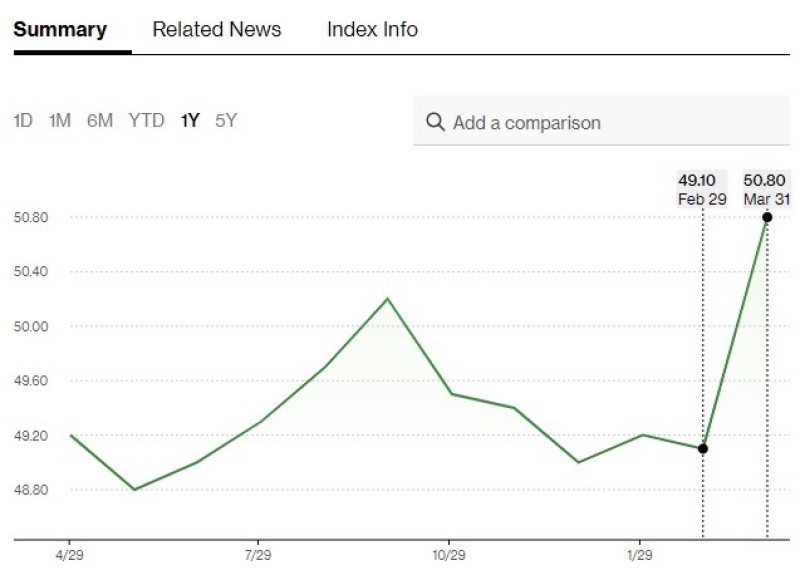

China's National Bureau of Statistics (NBS) data reveals a significant uptick in manufacturing activity, with the Manufacturing PMI rising to 50.8 in March from 49.1 in the previous month, signaling a potential recovery in the world's second-largest economy.

BoJ's Rate Hike Outlook

Former BOJ official Tsutomu Watanabe suggests a cautious approach to rate hikes, hinting at a possible delay until October at the earliest, attributing concerns over Yen depreciation as a key factor influencing the Bank of Japan's decision-making process.

Weak Consumer Inflation Expectations put pressure on the Australian Dollar, raising speculations of potential interest rate cuts by the Reserve Bank of Australia (RBA) later in 2024, with investors eagerly awaiting insights from the upcoming RBA Meeting Minutes scheduled for Tuesday.

Market participants closely monitor the RBA's policy stance and future directives, with the release of the Meeting Minutes expected to provide valuable insights into the central bank's assessment of economic conditions and potential policy adjustments.

Conclusion

AUD/JPY maintains upward momentum near 98.80, driven by optimistic Chinese PMI data, while market attention remains divided between the cautious stance of the Bank of Japan and expectations surrounding the Reserve Bank of Australia's policy direction. Investors await further clarity from upcoming economic indicators to navigate currency markets effectively.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah