A notable shift in whale behavior has shaken up the XRP (Ripple) market. Within two days, wallets holding between 100,000 and 10 million XRP collectively offloaded roughly $70 million worth of tokens — a move that's directly aligned with a visible drop in price. Recent on-chain data shows a clear connection between this mass distribution and XRP's weakening market structure, suggesting that large holders are the main drivers behind the current downward momentum.

Whale Selling Puts XRP Under Pressure

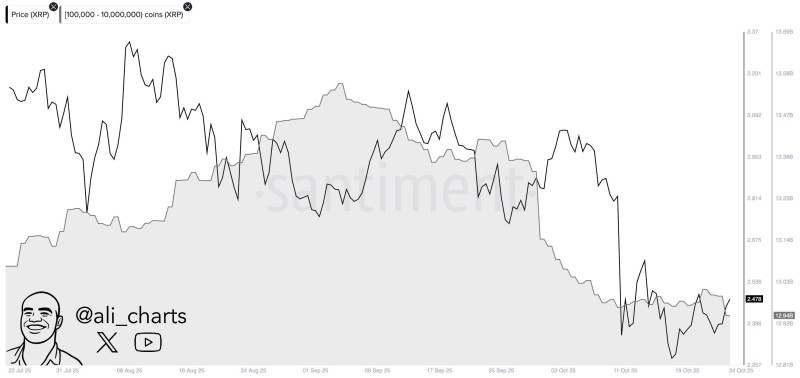

XRP has faced fresh selling pressure as large holders continue dumping significant portions of their stacks. According to crypto analyst Ali, wallets holding between 100,000 and 10 million XRP have been steadily declining, as reflected in Santiment's data.

The grey shaded area on the chart tracks these whale balances, which have been dropping consistently since mid-September, moving in lockstep with the black price line's downward trajectory. This parallel suggests whales are pulling back, likely locking in profits or cutting losses as uncertainty creeps into the broader crypto market.

Chart Analysis: Declining Confidence and Fading Momentum

The chart reveals several key technical shifts. From late July through mid-August, both whale holdings and XRP's price showed some strength before leveling off. By late August into September, a divergence emerged — whale balances started falling while price tried to hold steady, hinting at eroding confidence. From early October forward, both metrics dropped sharply. Whale holdings slid toward 12.9 billion XRP as the price line kept falling, reflecting sustained selling pressure. There's no clear sign of a rebound or accumulation zone yet, highlighting weak buying interest. The synchronized decline between whale holdings and price supports a bearish near-term outlook, with whales continuing to steer XRP's momentum.

Market Drivers and Context

Several macro factors may be fueling this recent selloff. Ripple's drawn-out legal battle with the SEC continues to dampen investor confidence, while broader market caution and capital rotation toward faster-moving altcoins like Solana and Ethereum could be accelerating the exodus from XRP. Additionally, following Bitcoin's latest volatility, investors might be seeking short-term safety, prompting XRP whales to trim their exposure. The ongoing drop in mid-sized wallet balances reflects a defensive posture rather than accumulation mode.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah