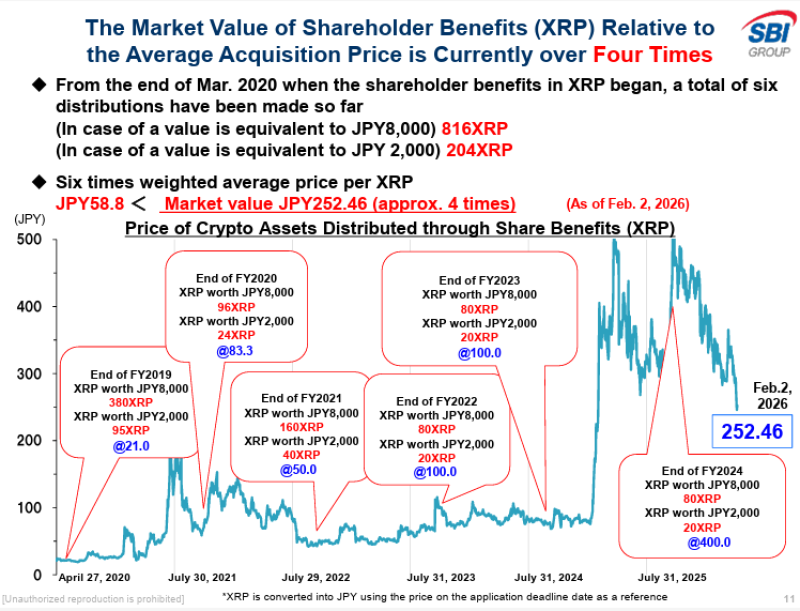

⬤ SBI shareholders who received XRP through the company's distribution program have seen their holdings grow to roughly four times the original value. Six distribution rounds over the years resulted in a weighted average acquisition price of around JPY 58.8 per XRP. With the token recently trading near JPY 252, that's a 4x return on the distributed tokens — no trading required.

⬤ The distributions span fiscal years 2019 through 2024, with each round priced at the reference rate at the time. Early allocations came in at prices far below where XRP trades today, which is largely what drives the overall multiple. The staggered schedule meant shareholders ended up with a blended cost basis that stayed well under current market levels — a dynamic explored further in XRP Targets $10 as Long-Term Holders Show Conviction.

The distributed holdings now represent roughly four times the original value.

⬤ SBI's ongoing commitment to distributing XRP to shareholders reflects broader institutional confidence in the asset. That confidence has translated into real gains for retail investors caught in the program's slipstream — not through speculation, but simply through holding. The story of growing institutional appetite has been covered in XRP (Ripple) Pulls in $11 Million as $2 Becomes the New Normal.

⬤ What this data really shows is how corporate crypto exposure can quietly compound over time. When token distributions are tied to market price, shareholder value moves in lockstep with the wider cryptocurrency cycle. As XRP's profile continues to rise — detailed in XRP (Ripple) Price Surges as SBI Executive Calls It Generational Wealth Transfer — programs like SBI's serve as a reminder that institutional positioning often benefits everyday shareholders just as much as the institutions themselves.

Peter Smith

Peter Smith

Peter Smith

Peter Smith