XRP is back in the spotlight as derivatives traders ramp up activity in the options market. A rapid increase in open interest indicates that speculators are betting on heightened volatility—and possibly a big move in the XRP price.

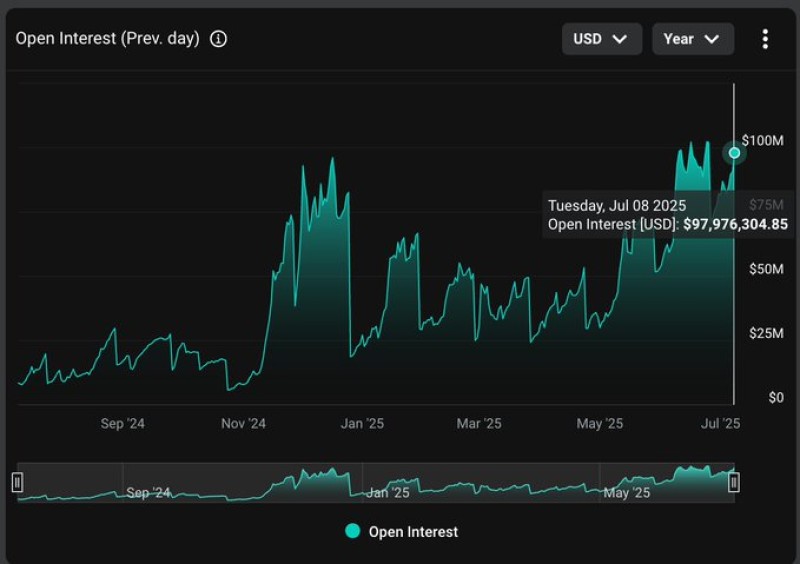

XRP Options Open Interest Hits $97.97M

XRP options open interest climbed to $97,976,304.85, nearing the $100 million milestone. This marks one of the highest levels seen in the past year. The chart illustrates a clear uptrend in derivatives activity since early 2025, reflecting strong market engagement.

The growing open interest suggests traders are building positions in anticipation of price swings. Historically, such spikes in open interest have often preceded significant moves in the spot price of XRP.

What This Means for XRP Price

With the current XRP price hovering above $2.40 and options market activity surging, investors are watching closely for signs of a breakout. If bullish momentum continues, XRP could test key resistance levels around $2.50 to $3.00 in the near term.

However, the buildup in speculative positions also introduces risk. A sudden reversal could lead to liquidations and sharp price corrections, particularly given the high leverage implied by recent options activity.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah