XRP (Ripple) has found itself at a crossroads following its decline since August 14, with on-chain data revealing a fascinating battle between different investor cohorts. While newer market participants are aggressively accumulating during the dip, seasoned long-term holders appear to be taking profits, creating conflicting market pressures that could determine the cryptocurrency's next major move.

XRP (Ripple) Holder Behavior Creates Market Division

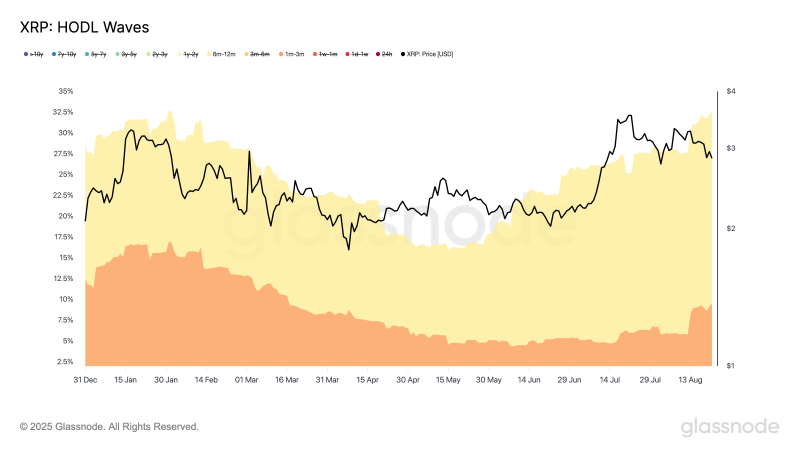

Short- and mid-term holders view the recent pullback as an opportunity to accumulate more XRP tokens. XRP's HODL Waves metric reveals that two investor cohorts are becoming increasingly active.

Short-term holders (1-3 months) currently control 9.51% of XRP's circulating supply and have increased their holdings by 8% since August 14. Mid-term investors have also joined the "buying the dip" strategy, with the 6–12 month cohort now controlling 23.19% of XRP's circulating supply, its highest share year-to-date.

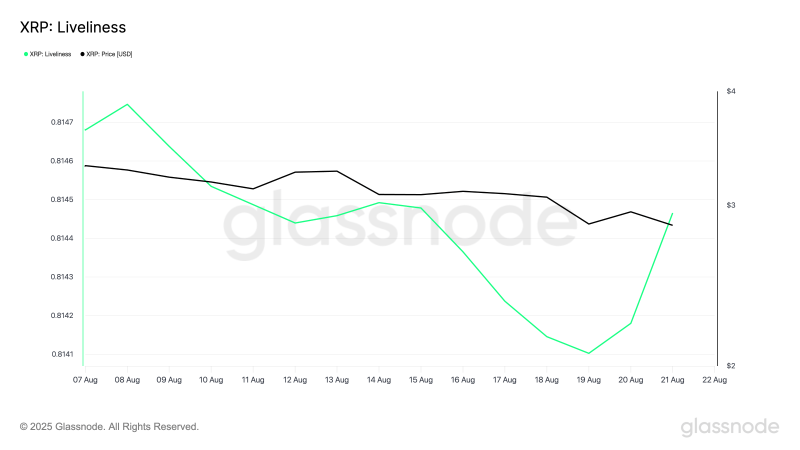

However, long-term holders (LTHs) are taking a different approach. XRP's Liveliness metric has climbed steadily since August 19, indicating that seasoned investors are moving or selling their coins.

This metric tracks the movement of long-held tokens by measuring the ratio of coin days destroyed to total coin days accumulated.

XRP Price Prediction: Critical Levels Ahead

The divergence between investor cohorts shows uncertainty surrounding XRP's trajectory. The cryptocurrency's recovery depends on whether fresh demand from newer buyers can outweigh selling pressure from long-term holders.

If accumulation efforts succeed, XRP could rebound, regain the $3 mark, and climb toward $3.22. However, if selloffs strengthen, XRP's price could extend its decline and drop to $2.63. The coming weeks will determine which investor group prevails in this battle between accumulation and distribution.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah