The cryptocurrency market is full of surprises, and XRP's recent performance is a perfect example. While most traders would expect heavy selling from the world's largest exchange to tank a coin's price, XRP has done the opposite. The token has been climbing steadily, and the reason might surprise you—it's all about timing and geography.

The Korean Connection Changes Everything

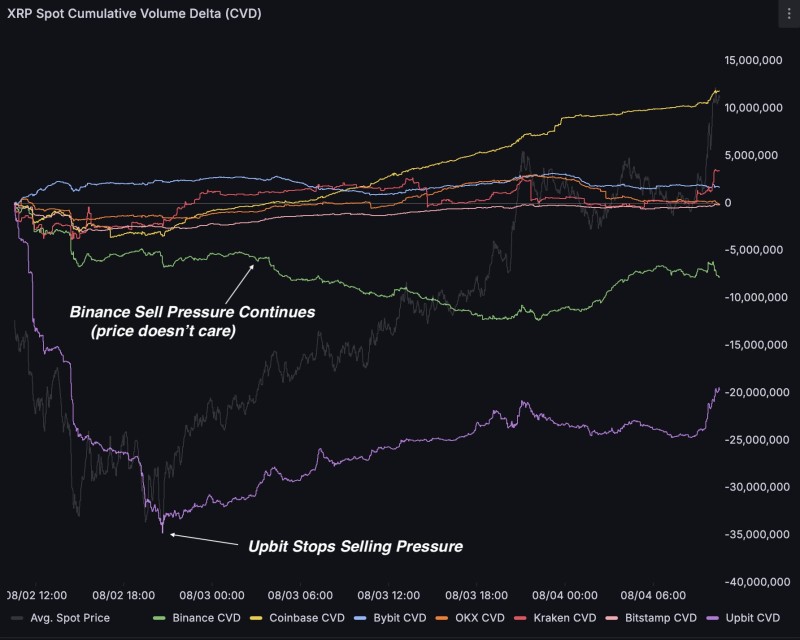

Here's what's been happening: Binance has been steadily selling XRP tokens, which should theoretically push the price down. But instead of crashing, XRP started recovering on August 3rd. The catalyst? Korean exchange Upbit suddenly stopped its own selling spree.

Looking at the trading data, it's clear that Upbit's decision to step back from selling was the turning point. While Binance kept dumping tokens (shown by the declining green line on volume charts), XRP's price reversed course the moment Upbit hit pause. This suggests Korean traders have way more influence on XRP than many people realize.

Coinbase Quietly Scoops Up 15 Million Tokens

Meanwhile, something interesting has been happening on Coinbase. Since XRP started its recovery, someone—likely a big institution—has been steadily buying up tokens. We're talking about nearly 15 million XRP purchased using what looks like a sophisticated buying strategy spread out over time.

This kind of accumulation pattern usually indicates serious money is backing the token, not just retail traders jumping on a trend.

What This Means for XRP's Future

The bigger picture here is fascinating. XRP is essentially climbing while fighting against selling pressure from the world's biggest crypto exchange. That's only possible because other major players are stepping in—Upbit stopped selling, and Coinbase is actively buying.

Currently trading above $0.63, XRP is showing that regional markets can sometimes matter more than global giants. Korean exchange activity, in particular, seems to be a key driver that traders should watch closely.

The "staircase" pattern in XRP's recent price action—slow but steady gains—suggests this isn't just a quick pump. It looks more like sustained accumulation from serious investors who believe in the token's longer-term prospects.

Peter Smith

Peter Smith

Peter Smith

Peter Smith