XRP takes a beating as it breaks below $3, with heavy selling from whales and retail traders sparking fears the recent rally might be over.

XRP just got hammered, falling below the key $3 level after failing to push past resistance around $3.15. The sell-off has been brutal, with both big players and regular traders dumping their bags. Now everyone's wondering if this is just a pullback or if the party's actually over.

XRP Price Technical Picture Looks Ugly

The charts are telling a clear story, and it's not good. The RSI has crashed to 29 – deep in oversold territory showing massive selling pressure. The On-Balance Volume (OBV) is also tanking hard, meaning aggressive selling with way less buying interest.

Put these together, and sellers are firmly in control. Unless buyers step up fast, XRP could easily slide to test $2.90 next. The support around current levels looks pretty weak.

XRP Price Bull Trap Caught Everyone Off Guard

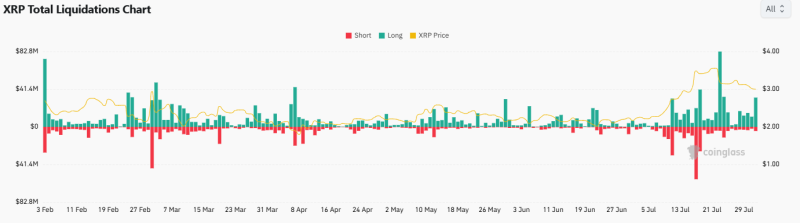

Binance liquidation data shows crazy activity just above $3.20 where leveraged longs got stacked up. Then boom – price reversed and all those positions got wiped out.

This screams bull trap. XRP lured in leveraged traders thinking it was going higher, then pulled the rug out. The cascade of liquidations made the sell-off even worse. Now below $3, there aren't many liquidation zones to provide support.

Smart Money Was Already Heading for the Exits

This wasn't panic selling. On-chain data shows XRP inflows to Binance spiked right around price peaks, meaning big players were planning their exit strategy. The latest deposits happened when XRP was above $3.40 – whales getting ready to sell into strength.

Sure, these numbers aren't as crazy as that $660 million spike from May, but the timing tells the story. The drop below $3 was calculated selling from people who knew what they were doing. If these exchange inflows keep up, they'll keep pressuring the price and make recovery much harder.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah