XRP (Ripple) just won't quit. Despite the broader crypto market's ups and downs, Ripple's token has been stubbornly camping above the $3 mark - and that's actually a pretty big deal. This isn't just some random number either. The $3 level represents what traders call a "value area high," basically the sweet spot where serious buyers have been stepping in.

What's got everyone talking isn't just the price action though. Ripple's been making some serious moves behind the scenes. They're rolling out a tokenized money market fund and stablecoin on DBS Digital Exchange, which is basically Ripple saying "we're not just a cryptocurrency anymore, we're infrastructure."

XRP Price Technical Setup Screams Bullish

Here's where things get interesting from a technical standpoint. XRP has been doing something that crypto traders absolutely love to see - it keeps making higher lows. Every time the price dips, it doesn't fall as far as the previous time. That's textbook bullish behavior right there.

The $3 support isn't just holding; it's acting like a trampoline. Each time XRP touches this level, buyers rush in like they're afraid they'll miss the train. And honestly, they might be onto something. The next target? $3.55. Break that, and we could see XRP making some serious moves toward higher resistance levels.

But here's what really caught my attention - Spanish banking giant BBVA just announced they're partnering with Ripple for institutional crypto custody services. When traditional banks start playing ball with crypto projects, you know something's shifting in the market.

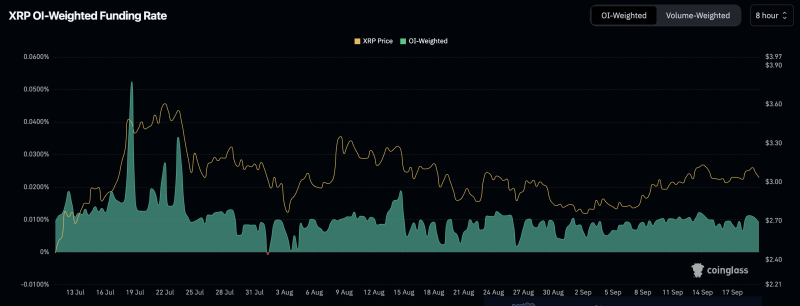

XRP Price Funding Rates Tell an Interesting Story

Now, let's talk about something most people overlook but smart money watches closely - funding rates. XRP's sitting pretty at around 0.02%, which in crypto terms means things are perfectly balanced. Neither the bulls nor the bears are getting too greedy, and that's actually bullish.

When funding rates are neutral at key resistance levels, it often means the market is taking a breather before making its next big move. No one's overleveraged, no one's panicking, and that creates the perfect environment for a sustained rally.

The volume tells a similar story. People aren't just gambling on XRP with borrowed money - they're actually buying and holding the real thing. That's the kind of demand that can fuel lasting price increases rather than those quick pump-and-dump scenarios we see too often in crypto.

What's Next for XRP Price?

Look, if XRP keeps holding this $3 level, we're probably looking at a test of $3.55 sooner rather than later. The setup is there, the fundamentals are improving with all these institutional partnerships, and the technical picture couldn't be much cleaner.

Sure, crypto markets can be wild and unpredictable, but right now XRP is doing everything a bullish asset should do. It's respecting support, making higher lows, and building the kind of foundation that often precedes significant breakouts.

The real kicker? All this institutional adoption stuff isn't just marketing fluff. When banks like BBVA start offering XRP custody services and exchanges like DBS start listing Ripple products, it signals that XRP is becoming legitimate financial infrastructure. And that's the kind of narrative that can drive serious, sustained price appreciation.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah