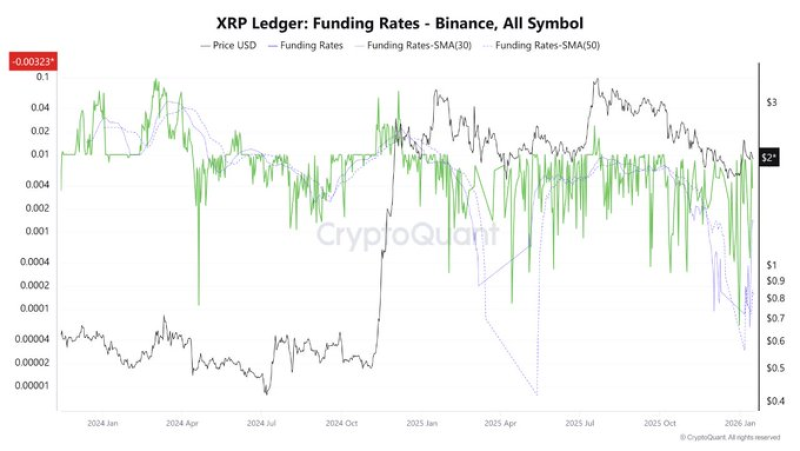

⬤ Binance funding data reveals a significant market shift, with XRP's funding rate plunging to approximately -0.00323. This means short traders are now paying to keep their positions open, a clear sign that bearish bets are piling up in the perpetual futures market. The negative funding shows growing pessimism around XRP even as the spot price trades within a relatively stable range.

⬤ Looking at historical patterns, extended negative funding periods often appear during peak market stress when one-sided positioning becomes extreme. The chart shows several previous occasions where funding rates crashed below zero while XRP's price either held steady or slowed its decline. When too many traders pile onto the same side, it creates imbalanced positioning that can shift quickly once conditions change.

⬤ Current data points to a compression phase building up. Funding rate averages keep trending lower while volatility spikes suggest uncertainty rather than strong directional conviction. This typically happens when leverage accumulates without clear price movement to support it. XRP has pulled back from recent highs but hasn't seen a chaotic selloff, meaning the negative sentiment is coming more from derivatives positioning than actual spot selling pressure.

⬤ Extreme funding rates matter because they make the market sensitive to sudden shifts. When rates stay deeply negative for extended periods, even small changes in buying pressure or sentiment can trigger forced position adjustments. Past cycles show that similar setups have preceded sharp price reactions as overleveraged positions get liquidated or sentiment flips. While funding rates alone don't predict price direction, they reveal how traders are positioned and how vulnerable the market might be to momentum changes or liquidity events.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova