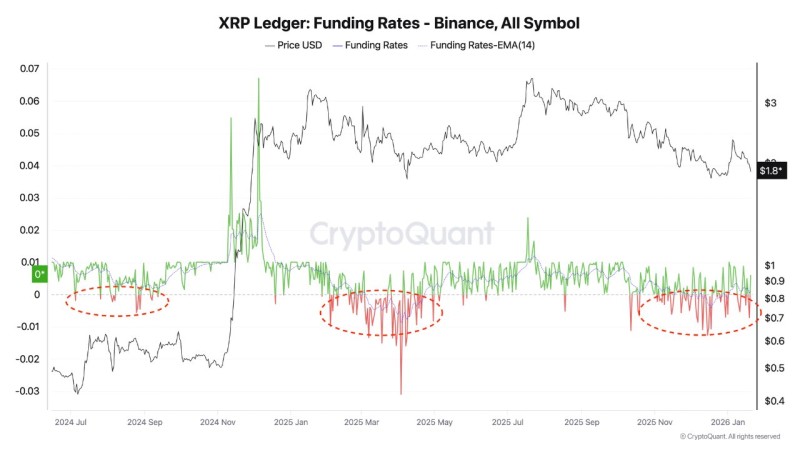

⬤ XRP derivatives markets showed a significant shift as funding rates across Binance futures moved into negative territory. This development signals a potential reversal point for XRP, according to market observers. The data reveals how funding behavior has changed even as price action stays relatively flat.

⬤ XRP has traded in a wide range over the past year, moving from below $0.70 to peaks around $1.80 before pulling back. During several phases, funding rates dipped below zero—periods highlighted on historical charts. Negative funding means short position holders are paying long position holders, showing a buildup of bearish bets in the derivatives market.

⬤ Recently, funding rates turned slightly negative again while XRP stabilized near the lower end of its range. The 14-period funding rate moving average has flattened close to zero, suggesting traders lack strong directional conviction despite cautious positioning. This pattern echoes earlier periods in mid-2024 and mid-2025 when negative funding coincided with consolidation rather than sharp price moves. Binance serves as a key reference point since it's one of the largest venues for XRP perpetual futures.

⬤ Funding rates matter because they reveal trader positioning and sentiment in crypto derivatives markets. When negative funding persists, it often indicates overcrowded short positions—a setup that has historically led to increased volatility when traders adjust their bets. For XRP, this shift in funding dynamics could influence near-term price action as the market decides whether the current consolidation continues or breaks into a new trend.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir