- XRP May Magic: Why This Month Could Change Everything

- XRP Breaking the Curse: Six Years of May Heartbreak Finally Ending?

- XRP Institutional FOMO: The Game-Changer Everyone's Been Waiting For

- XRP Technical Picture: Charts Don't Lie About This $3 Setup

- XRP Market Reality Check: Why $3 Actually Makes Sense Now

XRP is making a serious run at the $3 level, backed by historical data showing 26% average May gains and fresh institutional momentum that could finally break the six-year drought.

XRP May Magic: Why This Month Could Change Everything

XRP is absolutely crushing it right now, and if you know anything about crypto history, you'll understand why May has traders buzzing with excitement. The token just spiked nearly 4%, pushing hard toward $2.50, but that's just the warm-up act for what could be an epic month.

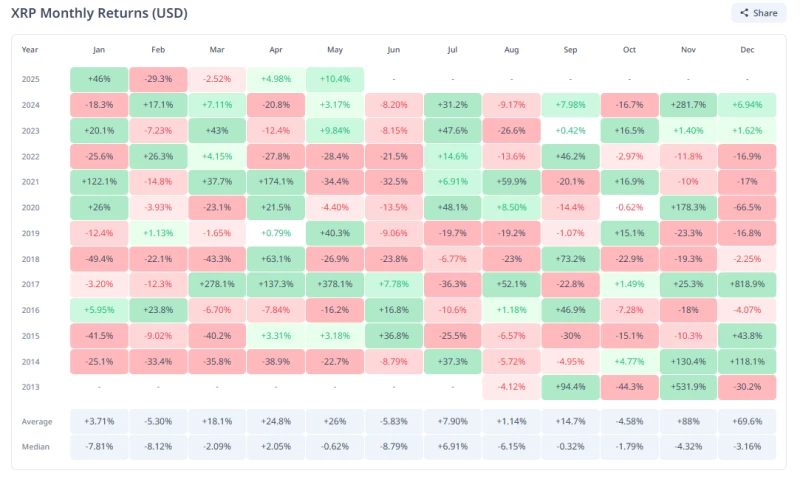

Here's the kicker – according to Cryptorank data, XRP historically averages a massive 26% gain in May. Yeah, you read that right. Twenty-six percent. In a single month. While the broader crypto market is riding high, XRP's specific May performance pattern has traders eyeing that sweet $3 milestone that's been playing hard to get for way too long.

Right now, XRP is sitting pretty at $2.42, up 3.03% in the last 24 hours and already flexing with a daily high of $2.45. But here's where it gets really juicy – trading volume has exploded 53.02% to $4.49 billion. When you see volume like that, you know something big is brewing.

If XRP can tap into its historical May mojo and actually hit that 26% growth rate, we're looking at a price target of $3.02 before the month's over. That's not just breaking $3 – that's smashing right through it and leaving doubters in the dust.

XRP Breaking the Curse: Six Years of May Heartbreak Finally Ending?

Let's be honest – XRP's May performance has been pretty brutal since 2019. We're talking about a six-year streak where the token just couldn't deliver on its historical promise. The numbers don't lie: XRP got hammered in May 2020, 2021, and 2022 with losses of 4.40%, 34.4%, and 28.4% respectively. Ouch.

Things started looking up in 2023 and 2024 when XRP finally posted positive May gains of 9.84% and 3.17%, but let's face it – those numbers were still nowhere near that tantalizing 26% historical average that had everyone dreaming of moon shots.

Fast forward to 2025, and XRP is already sitting on a 10.7% gain for May – not even halfway through the month. That's already crushing last year's performance and showing zero signs of slowing down. The momentum is real, the volume is there, and for the first time in years, it actually feels like XRP might break this frustrating pattern.

What's different this time? Everything. The market conditions are night and day compared to the past few years. Bitcoin's flirting with all-time highs, institutional money is flooding back into crypto, and XRP finally has the regulatory clarity it desperately needed. This isn't just another false start – this could be the year XRP reclaims its May throne.

The bears have had their fun for six years, but if this rally has legs, we could be looking at XRP not just meeting but absolutely crushing that 26% historical average. And when that happens, $3 won't just be a target – it'll be a launching pad.

XRP Institutional FOMO: The Game-Changer Everyone's Been Waiting For

Forget the technical analysis for a minute – the real story here is what's happening behind the scenes with institutional money. That messy legal battle with the SEC? Finally settled. Suddenly, all those institutional players who were sitting on their hands are jumping back into the XRP game with both feet.

Check this out: the Tectrium 2x Long Daily XRP ETF is sitting on over $120 million in assets under management. That's serious money betting on XRP's future, and it's basically serving as a preview for what's coming with spot XRP ETFs. Volatility Shares saw the writing on the wall too, launching their own 1x XRP ETF focused on futures.

Sure, the SEC is still dragging their feet on spot ETF approvals, but smart money doesn't wait around for government bureaucrats to make up their minds. They're positioning themselves now for what everyone knows is inevitable. This institutional FOMO could be exactly the catalyst XRP needs to finally break through that stubborn $3 resistance.

But it's not just about ETFs. Banks and payment processors that were scared to touch XRP during the SEC drama are now taking another look. Remember, XRP was originally designed for cross-border payments, and with regulatory clarity finally here, real utility-based demand is starting to kick in alongside all the speculative trading.

This isn't just retail investors throwing money at the latest shiny object. This is institutional-grade money recognizing XRP's potential and positioning accordingly. When institutions start moving, retail usually follows, and that's when price movements get really interesting.

XRP Technical Picture: Charts Don't Lie About This $3 Setup

From a chart perspective, XRP is setting up beautifully for a major breakout. That 4% spike wasn't just random market noise – it punched through some key resistance levels with authority, and the volume surge to $4.49 billion tells you this move has serious backing.

The $2.50 level XRP is approaching right now? That's been a major psychological barrier for ages. If XRP can break and hold above this level cleanly, it's going to trigger a whole new wave of buying from traders who've been waiting on the sidelines for confirmation. Technical guys are watching this level like hawks because a clean break could open the floodgates to $3.

What's really got technical analysts excited is how perfectly XRP's current price action matches its historical May patterns. The gradual build-up, the increasing volume, the steady climb – it's all textbook XRP May behavior from the years when it actually delivered those monster gains.

That 26% historical average would put XRP at $3.02, and here's the thing about round numbers in crypto – they tend to create serious FOMO when they get broken. $3 isn't just another price level; it's a psychological barrier that, once broken, could trigger a feeding frenzy.

With current monthly gains at 10.7% and three weeks left in May, XRP has plenty of time to hit that historical average. And with institutional demand building and regulatory clouds finally clearing, there's more fundamental support for this rally than XRP has had in years.

XRP Market Reality Check: Why $3 Actually Makes Sense Now

Let's talk about why $3 isn't just some random number pulled out of thin air. Breaking into the $3 range would put XRP back on the map as a serious player in the crypto space, not just another altcoin trying to catch lightning in a bottle.

The market conditions right now are honestly the best XRP has seen since its legendary 2018 run. You've got legal clarity, institutional interest that's actually real this time, and a broader crypto market that's firing on all cylinders. When all these factors align during XRP's historically strongest month, magic tends to happen.

That volume explosion to $4.49 billion with a 53.02% increase? That's not retail investors throwing lunch money around. That's serious institutional money taking serious positions because they see something big coming. This kind of volume usually precedes major price movements, and all signs point upward.

XRP sitting at $2.42 and pushing toward $2.50 puts it in striking distance of $3. If the historical patterns hold and XRP can deliver even a fraction of its 26% average May performance, $3 isn't just possible – it's practically inevitable.

For everyone who's been holding XRP through the regulatory nightmare, the legal battles, and the endless delays, this May could be the month that makes it all worth it. The convergence of historical patterns, improving fundamentals, and favorable market conditions is creating a perfect storm that could finally push XRP past that elusive $3 level.

The bears have had their fun for six years, but momentum is shifting. With three weeks left in May and all systems firing, XRP holders might finally get the breakout they've been dreaming about since 2019. Sometimes the stars just align, and for XRP, that alignment is looking pretty damn good right now.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah