The cryptocurrency market is taking another big step toward mainstream acceptance as the first spot XRP exchange-traded fund gets closer to reality. Canary Capital's "Canary XRP ETF" is eyeing November 13 as its launch date, according to recent regulatory documents. This could be a game-changer for XRP, potentially putting it alongside Bitcoin and Ethereum as one of the few cryptocurrencies with a spot ETF available to U.S. investors.

XRP's First Spot ETF Nears Launch

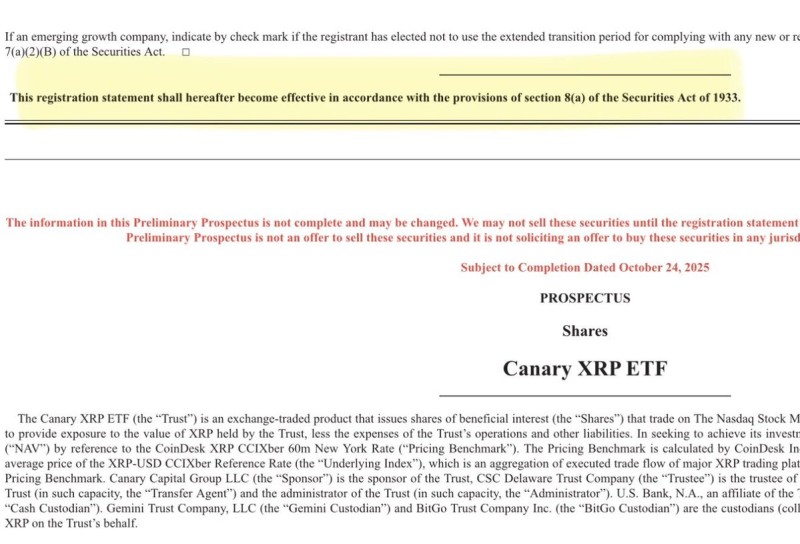

The prospectus shows that the registration statement "shall hereafter become effective in accordance with the provisions of section 8(a) of the Securities Act of 1933."

In plain English, this means the ETF is on track to launch unless the SEC steps in with a stop order. Everything points to the product going live within days.

What This Means for the Market

The timing couldn't be more interesting. The crypto industry has been navigating a complex regulatory landscape, with ongoing discussions about taxation, compliance requirements, and investor protections. An XRP ETF adds another layer to these conversations, particularly around how digital assets should be taxed and regulated.

Some worry that stricter rules could hurt liquidity or drive capital away from the U.S. market. Others believe that clear regulations would actually help by giving institutional investors the confidence they need to jump in. The reality is probably somewhere in between. Regulated investment products like ETFs tend to generate predictable tax revenue through management fees and capital gains, which could make regulators more comfortable with the broader crypto ecosystem.

Infrastructure and Institutional Access

Behind the scenes, there's serious institutional infrastructure making this ETF possible:

- Sponsor: Canary Capital Group LLC

- Digital asset custodians: Gemini Trust Company and BitGo Trust Company

- Additional roles: trustee, transfer agent, and cash custodian

This setup shows just how much institutional-grade infrastructure has developed in the crypto space. For investors who've been hesitant about holding XRP directly—whether due to custody concerns or regulatory uncertainty—this ETF offers a straightforward, regulated alternative.

Potential Market Impact

If this ETF launches as expected, it could reshape XRP's market dynamics. Institutional money that's been sitting on the sidelines might finally enter the picture. We've seen what happened with Bitcoin and Ethereum ETFs—significant inflows that pushed prices higher. Whether XRP follows a similar path will depend on investor appetite and broader market conditions, but the door is definitely opening.

Some market watchers are already talking about ambitious price targets, suggesting that increased accessibility could lead to substantial gains. Time will tell if those predictions pan out, but the launch itself represents a major milestone regardless of short-term price action.

Looking Ahead

Assuming no last-minute regulatory hurdles, XRP is about to join an exclusive club. The broader implications stretch beyond just one cryptocurrency—each new spot ETF approval sets precedents for future products and helps normalize crypto as an institutional asset class. Whether you're bullish on XRP specifically or just interested in crypto's evolution, November 13 is shaping up to be a date worth watching.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi