A groundbreaking report from Malaysia's Central Bank has sent shockwaves through the cryptocurrency community, suggesting that XRP could potentially replace traditional bank deposits as a payment method outside the conventional banking system. This development comes as Bitcoin and Ethereum face criticism for their scalability limitations, positioning Ripple's XRP as a more viable alternative for future payment infrastructure.

Malaysia Central Bank Endorses XRP for Payment Systems

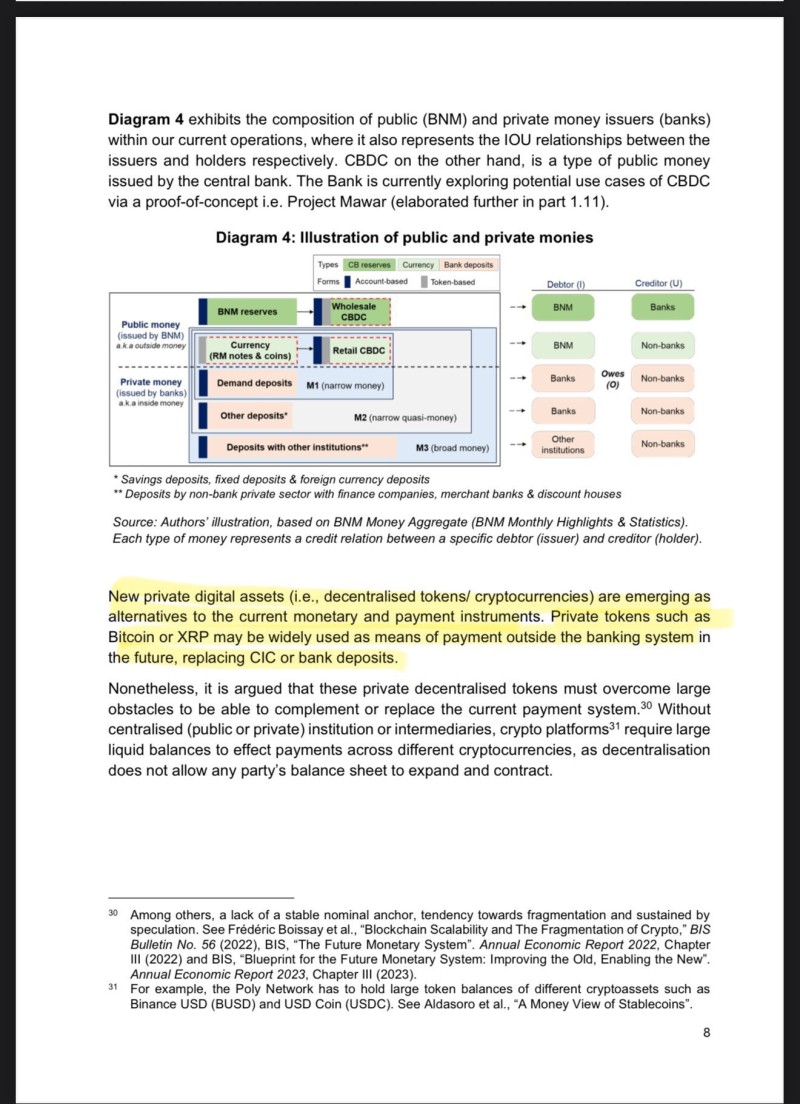

The 2025 report from Bank Negara Malaysia presents a fascinating shift in institutional perspective toward digital assets. According to trader SMQKE, who highlighted these findings, the central bank specifically noted that "private tokens such as XRP may be widely used as means of payment outside the banking system in the future, replacing CIC or bank deposits."

This endorsement represents more than just theoretical speculation. Malaysia's central bank appears to be acknowledging XRP's unique position in the cryptocurrency ecosystem, particularly its focus on cross-border payments and institutional adoption. Unlike many other digital assets that struggle with transaction speeds and costs, XRP was designed specifically to facilitate rapid, low-cost international transfers.

XRP's Competitive Advantage in Payment Infrastructure

XRP's potential recognition by Malaysia's central bank isn't accidental. The token was specifically engineered to address the shortcomings that plague traditional cryptocurrencies in payment scenarios. With the ability to process over 1,500 transactions per second at a fraction of the cost of Bitcoin or Ethereum transactions, XRP presents a compelling case for institutional adoption.

Ripple's ongoing partnerships with financial institutions worldwide have demonstrated XRP's practical utility in real-world payment scenarios. The company's focus on regulatory compliance and working within existing financial frameworks aligns well with central bank requirements for stability and oversight.

Implications for the Broader Cryptocurrency Market

This development could signal a broader shift in how central banks and financial regulators view different categories of cryptocurrencies. Rather than treating all digital assets as speculative investments, there's growing recognition that some tokens serve specific utility functions that could complement or enhance traditional financial systems.

The distinction drawn between XRP and other major cryptocurrencies suggests that regulatory bodies are becoming more sophisticated in their understanding of blockchain technology's various applications. This nuanced approach could pave the way for more targeted regulations that support innovation while maintaining financial stability.

Looking Ahead: The Future of Digital Payments

Malaysia's central bank report represents just one data point in the evolving landscape of digital payments. However, when a national monetary authority suggests that a specific cryptocurrency could replace traditional banking deposits, it demands attention from investors, policymakers, and financial institutions globally.

The success of such integration would depend on numerous factors, including regulatory frameworks, technological infrastructure, and public acceptance. Yet the mere consideration of XRP in this context underscores the token's potential role in the future of global finance.

As the cryptocurrency market continues to mature, distinctions between different types of digital assets are becoming more pronounced. While Bitcoin maintains its position as digital gold and Ethereum dominates decentralized finance, XRP appears to be carving out its niche as the bridge between traditional finance and the digital asset ecosystem. This Malaysian central bank report might just be the beginning of broader institutional recognition for payment-focused cryptocurrencies.

Peter Smith

Peter Smith

Peter Smith

Peter Smith