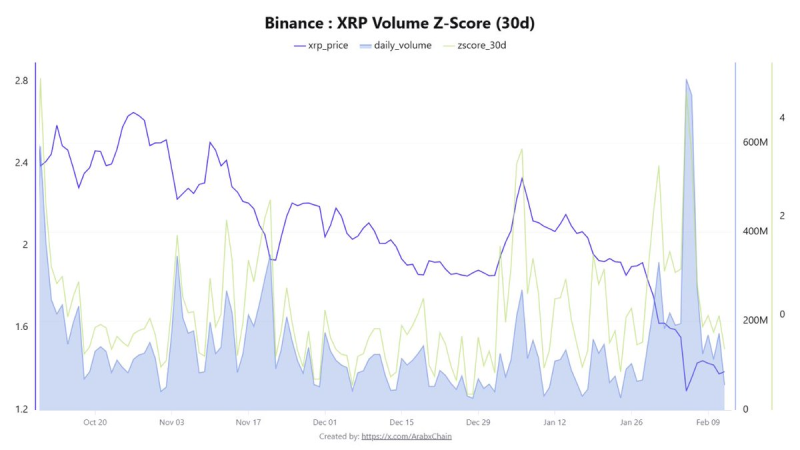

⬤ XRP is going through a quiet phase right now, with trading activity on Binance sitting right around its 30-day average. The volume Z-Score is hovering near 0—basically pointing to "pure equilibrium" rather than any real surge in participation. Price is hanging around $1.37, and the chart backs this up by showing muted Z-Score readings alongside pretty steady volume compared to earlier spikes.

⬤ The Binance volume Z-Score tracks how much current trading volume differs from its recent 30-day norm. When it sits near zero, you're looking at consolidation, not exhaustion—participation isn't ramping up or falling off a cliff. The argument here is that these calm stretches often come right before strong directional moves. The chart confirms it: notable XRP price swings have typically lined up with periods when the volume Z-Score shot up sharply from low baseline levels.

⬤ The bullish signal to watch for is a Z-Score breakout above +2, which would mean a real expansion in volume. Similar setups involving compression, liquidity dynamics, and volume patterns have popped up before in XRP Trades in Heavy $1.60 Liquidity Zone as Daily Volume Spikes and XRP Drops 2.4% to $1.90 as Volatility Cools and Market Enters Compression Phase.

⬤ Why does this matter? Consolidation phases like this one usually wrap up with a volatility expansion once activity clearly shifts away from equilibrium. If the Binance volume Z-Score keeps sitting near zero, expect more range-bound action. But if it breaks above +2, that's a clear shift in participation intensity—and it could bring stronger price movement along with it.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah