Tether (USDT), the largest stablecoin issuer, has opted against launching its blockchain, citing market saturation and a preference for existing solutions.

Off the Blockchain Bandwagon: Why Tether (USDT) Won’t Join

In a world where crypto projects are racing to launch their blockchains, Tether Holdings, the company behind the world’s largest stablecoin USDT, has made a contrarian choice. Despite its vast resources and technological capabilities, Tether has decided against creating its blockchain. The reason is simple: an oversaturated market where even the most innovative technology can struggle to stand out.

Tether’s decision not to launch its own distributed ledger was driven by a classic economic principle—supply and demand. Paolo Ardoino, CEO of Tether, highlighted this in a recent interview with Bloomberg News: "We are very good in technology, but I think blockchains will become almost a commodity in the future. Launching a blockchain ourselves might not be the right move. There are very good blockchains.”

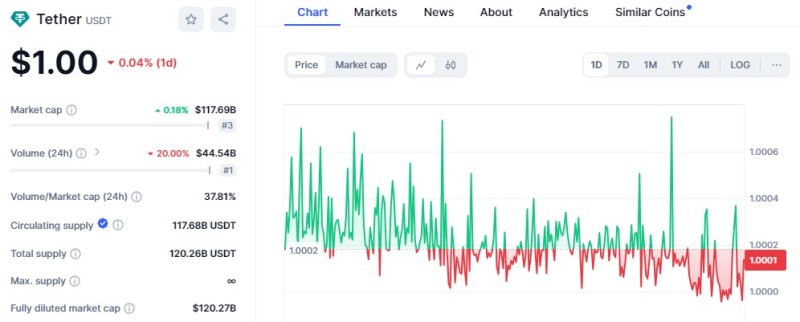

Given USDT’s wide usage for trading and remittances, one might think launching a dedicated blockchain would be a natural next step for Tether. After all, with a market cap of $117 billion, Tether has the resources to pull it off. However, the numbers tell a different story.

The Blockchain Landscape: A Crowded Market

Data paints a clear picture of the blockchain market’s current state. Out of 306 chains, the top five control roughly 86% of the ecosystem's total value locked (TVL). Ethereum, the dominant blockchain, boasts a TVL of $87.7 billion out of a total of $133.2 billion. TRON, a blockchain launched by Justin Sun in 2017, manages $8.1 billion in TVL and handles 49% of the USDT supply. With these giants leading the market, launching another blockchain would add little value.

High transaction speeds, low fees, and robust security are essential for any blockchain’s success. Ethereum’s dominance can be attributed to its early start, flexibility for smart contract development, and the liquidity of its token, despite its high fees.

The multichain nature of the current ecosystem allows projects to benefit from multiple platforms. Angela Ang, senior policy adviser at blockchain intelligence firm TRM Labs, pointed out that success depends on offering unique utilities such as speed, security, or interoperability—features that may not be achievable with a new entrant.

Ardoino expressed satisfaction with remaining blockchain “agnostic,” emphasizing that for Tether, blockchains are merely “transport layers.” As long as the platforms USDT operates on provide top-tier security and sustainability, there’s no need for Tether to complicate things with its chain.

Conclusion

Tether’s choice to avoid launching its blockchain underscores a strategic preference for stability and security over adding another chain to an already crowded field. As the blockchain ecosystem continues to evolve, Tether remains focused on ensuring its stablecoin can operate seamlessly across the most secure and efficient platforms available.

Usman Salis

Usman Salis

Usman Salis

Usman Salis