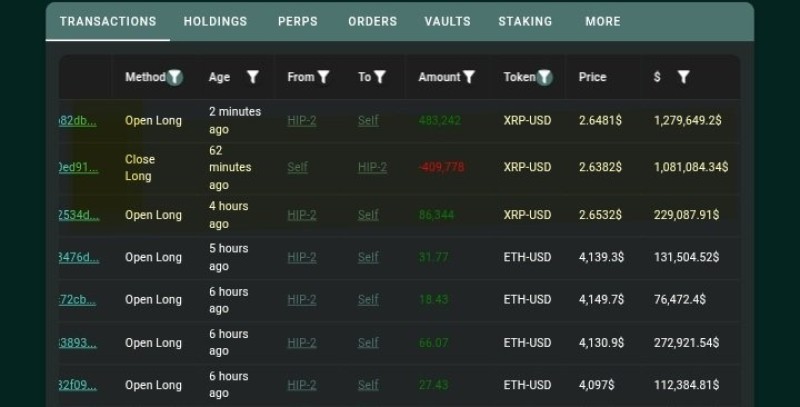

XRP (Ripple) derivatives market is heating up again, and one major trader just made a bold move. According to data from Hyperliquid, a whale executed a $1.27 million long position on XRP/USD at $2.6481, signaling confidence in the token's next potential leg upward. The transaction appeared only minutes ago, immediately drawing attention from traders tracking large positions.

Fresh Whale Activity on Hyperliquid

Xaif Crypto trader data shows the whale recently closed a $1.08 million long at $2.6382, locking in profit before reopening a larger position at slightly higher levels. Such re-entries often indicate strong conviction that the market is building momentum rather than topping out.

The data also reveals consistent activity over the past few hours, with multiple XRP and ETH long positions opened by high-value accounts. Among them, this XRP trade stands out as the largest, reinforcing the narrative of renewed institutional interest and speculative appetite returning to the altcoin market.

Technical Context: XRP's Key Support Zone Around $2.60

From a technical standpoint, XRP has been trading within a narrow consolidation channel above $2.60, establishing a firm base ahead of potential volatility expansion. The $2.63–$2.65 range where this whale entered aligns closely with the short-term resistance observed on higher timeframes. If bulls can maintain control above this zone, upside targets around $2.85–$3.00 could come into play. Conversely, a failure to hold the current level might trigger a temporary pullback toward $2.50, where new liquidity could form before any further move upward.

Market Drivers and Whale Confidence

The timing of this position comes amid renewed optimism surrounding Ripple's regulatory clarity and expanding partnerships in the financial technology sector. XRP has continued to attract attention as a bridge asset for global payments, bolstered by institutional integration and speculation of broader use cases in 2025. Large whale entries like this often reflect a combination of technical conviction and fundamental positioning, especially as overall crypto market liquidity improves and traders seek exposure to high-momentum assets. The broader context also links to ongoing AI infrastructure expansion led by companies like NVIDIA, which has been fueling risk appetite across tech and digital asset markets. This macro backdrop could indirectly benefit XRP's positioning as part of the evolving digital finance ecosystem.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi