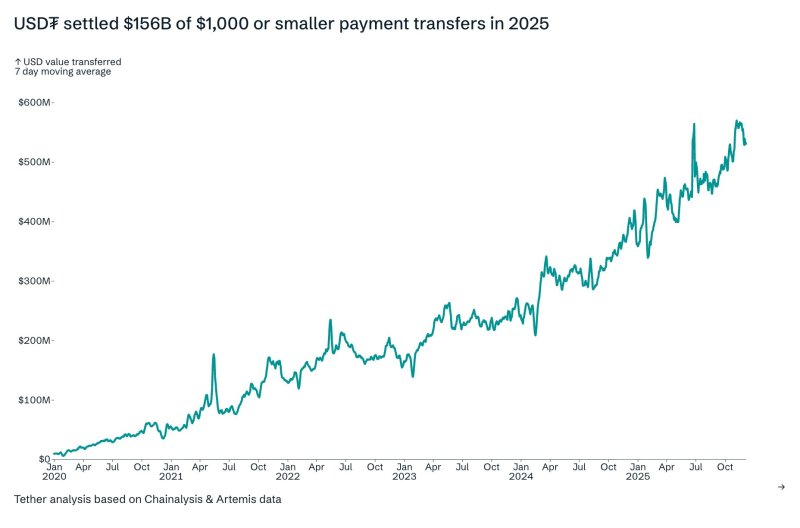

⬤ On-chain data reveals that USDT processed $156 billion in payment transfers under $1,000 during 2025. The numbers show a clear pattern—daily transaction volumes climbed above $500 million this year, with the seven-day moving average trending steadily upward. This isn't about a few massive whale moves. It's about regular people making frequent, smaller payments.

⬤ Looking back over the past five years, the growth has been consistent rather than explosive. Small USDT transfers started picking up momentum in 2020 and kept climbing through the market swings of 2022 and 2023. Even when prices crashed and volatility spiked, these everyday transactions kept flowing. By 2025, the pace accelerated noticeably, suggesting USDT has become woven into people's daily financial routines rather than just sitting idle as trading collateral.

This milestone reflects the growing scale of USDT usage in frequent, lower-denomination payments rather than isolated large transfers.

⬤ The data comes from Chainalysis and Artemis tracking systems, which monitor blockchain activity and sort transactions by size. Payments under $1,000 typically cover peer-to-peer transfers, remittances, exchange settlements, and small trading moves—the kind of stuff that happens constantly rather than occasionally. The rising averages point to more wallets staying active and more transactions happening per user.

⬤ What makes this trend worth watching is how it shifts USDT's role in the market. The stablecoin isn't just parked on exchanges waiting for the next trade anymore—it's actually moving around as payment infrastructure. When billions flow through small everyday transactions, it means USDT is becoming embedded in how people actually use crypto, not just how they speculate with it. That kind of adoption changes how liquidity moves and how stable the broader ecosystem becomes.

Peter Smith

Peter Smith

Peter Smith

Peter Smith