After months of steady decline, TRON Inc. ($TRON) appears to be stabilizing in what some traders see as a prime accumulation zone. With improved valuations and a strategic approach to TRX holdings, the stock may be setting up for a significant rally that could push prices well beyond current levels.

Finding Support After the Fall

Trader @Intuit_Trading recently reminded his followers that he'd flagged the $1–$2 range as a strong buying opportunity when TRON was trading near $10. Now that the stock has pulled back into that zone, he's started building a position, noting that the price-to-NAV ratio looks much more attractive at these levels.

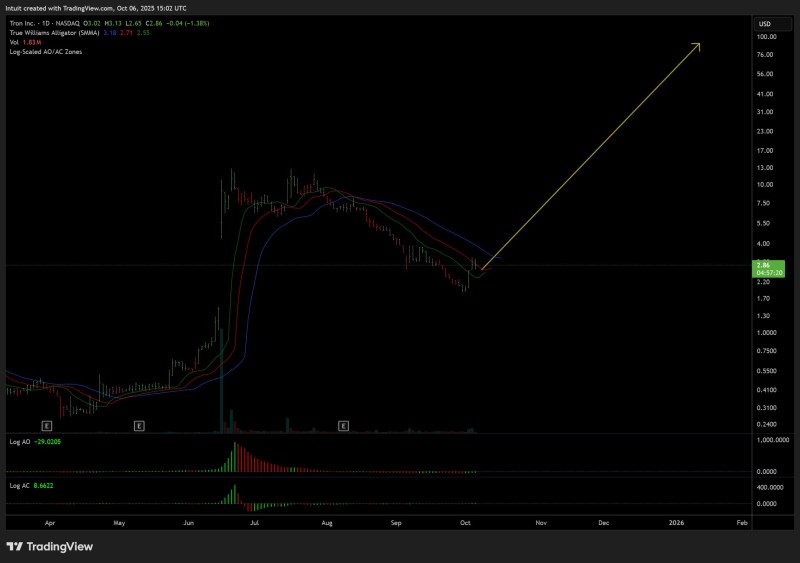

The chart backs up this view. After months of selling pressure, TRON is showing early signs of stabilization around $2.86. Technical indicators like the Williams Alligator suggest bearish momentum is running out of steam, and the stock may be gearing up for a reversal.

What makes TRON potentially interesting isn't just the price drop—it's the company's exposure to TRX and the yield it generates. @Intuit_Trading describes a self-reinforcing cycle he calls a "reflexivity engine." The idea is simple: TRON raises capital through equity or debt, uses it to buy more TRX, earns yield on those holdings, and reinvests the proceeds into further expansion. If management executes this aggressively, the balance sheet could grow significantly over time. In a scenario where TRX itself rallies into single or double-digit territory, the trader believes TRON stock could hit $100 per share.

What the Chart Shows

At $2.86, TRON is sitting in what looks like an accumulation zone between $1.70 and $2.00. Momentum indicators are showing declining selling pressure, and there's a hint of reversal forming. The chart includes a long yellow arrow pointing sharply upward, suggesting the potential for substantial gains if buying momentum picks up. A breakout above near-term resistance could be the catalyst that sparks the next leg higher.

The path to $100 is speculative and depends heavily on both crypto market conditions and how well TRON Inc. management executes its strategy. But the setup is intriguing: attractive entry prices, improving technicals, and a clear growth mechanism tied to TRX accumulation. For traders willing to take on the risk, TRON is flashing early signs of recovery, and a confirmed breakout could mark the beginning of something bigger.

Usman Salis

Usman Salis

Usman Salis

Usman Salis