- BNB Gears Up for Game-Changing Maxwell Update While Charts Scream "Buy"

- Polkadot (DOT) Finally Rolling Out Elastic Scaling with a Juicy 11.5% Staking Reward

- PEPE's Not Just Another Meme Coin – Whales Are Loading Up While You're Sleeping

- Solana (SOL) About to Ditch Proof-of-History in Major Alpenglow Overhaul

- Monero (XMR) Surges 12.6% as Privacy Makes a Comeback

Bitcoin's pushing toward its all-time high after May's bull run, but these five digital assets might be your best bet for June, even with the traditionally tough seasonal headwinds.

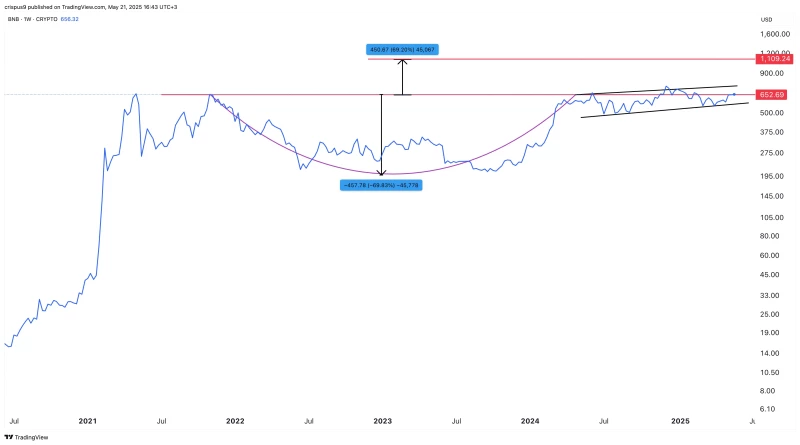

BNB Gears Up for Game-Changing Maxwell Update While Charts Scream "Buy"

Binance Coin (BNB) has caught the eye of serious crypto investors this June, and for good reason. The BNB Smart Chain is about to drop its third major upgrade of the year – Maxwell – and it's a big one. We're talking about slashing block times down to a mere 0.75 seconds with sub-second transaction speeds, all while handling a mind-boggling 100 million transactions daily.

This isn't their first rodeo either. April's Lorentz upgrade already cut transaction times in half (from 3 seconds to 1.5), while the Pascal hard fork boosted Ethereum Virtual Machine compatibility across the board.

Take one look at BNB's weekly chart and you'll spot the textbook cup and handle pattern forming. Technical traders know what this means – we could be looking at a serious breakout toward the $1,000 mark. Between the solid tech improvements and that mouth-watering chart setup, BNB deserves a spot on your June watchlist.

Polkadot (DOT) Finally Rolling Out Elastic Scaling with a Juicy 11.5% Staking Reward

Polkadot (DOT) is flying surprisingly under the radar given what's coming down the pipeline. The big news? Elastic scaling – the final piece of the Polkadot 2.0 puzzle – is about to go live after successful testing on Kusama.

This isn't just another minor update. Elastic scaling lets parachains dynamically allocate multiple cores to a single task, basically allowing on-demand scaling of both computing power and data throughput. The other two pieces of this upgrade – agile coretime and asynchronous backing – are already humming along nicely.

Let's not overlook that massive 11.5% staking yield either. In a market where yield is king, that's nothing to sneeze at. Chart-wise, DOT has put in a solid double-bottom at $3.60 and is working through the CD phase of the XABCD harmonic pattern. Translation? The technical picture looks promising for a summer rally.

PEPE's Not Just Another Meme Coin – Whales Are Loading Up While You're Sleeping

Don't roll your eyes just yet – PEPE has quietly become one of the more technically interesting plays for June. The daily chart shows a textbook bullish flag formation that's been developing for weeks, with price action already punching through the crucial 61.8% Fibonacci retracement level at $0.000017.

What's really got traders buzzing is the imminent golden cross forming as the 50-day and 200-day weighted moving averages converge. Meanwhile, wallet tracking shows larger holders (the so-called "whales") have been accumulating without much fanfare.

If these technical signals play out as expected, we could see PEPE retesting its previous all-time high of $0.000028. Not bad for a coin with a frog as its mascot, right?

Solana (SOL) About to Ditch Proof-of-History in Major Alpenglow Overhaul

Solana (SOL) continues to push the boundaries of blockchain tech with its upcoming Alpenglow update – perhaps the most significant change to its architecture since launch. The team is replacing both the proof-of-history and TowerBFT consensus mechanisms, a move that promises to slash latency and make Solana even more suited for real-time applications.

Considering Solana's already impressive transaction speeds, this upgrade could cement its position as the go-to chain for applications that can't afford to wait. DeFi traders, gaming enthusiasts, and NFT collectors are all keeping close tabs on this development.

From a trading perspective, SOL has formed both a bullish flag and a falling wedge on the daily chart – two patterns that typically precede significant upward moves. With a golden cross about to trigger, don't be shocked if SOL makes a serious run at its previous all-time high in the coming weeks.

Monero (XMR) Surges 12.6% as Privacy Makes a Comeback

In a somewhat unexpected twist, Monero (XMR) has shot up 12.6% to $392.37, making it one of June's early winners. As the OG privacy coin, Monero seems to be benefiting from renewed interest in financial confidentiality.

In a world where digital footprints are becoming increasingly valuable (and vulnerable), Monero's sophisticated privacy tech – ring signatures, stealth addresses, and RingCT – offers something that most mainstream cryptos simply can't: genuine transaction anonymity.

Despite the regulatory headaches that have plagued privacy coins over the years, XMR's dedicated dev team and passionate community have kept the project not just alive but thriving. The recent price action suggests we might be seeing a broader shift back toward privacy-focused assets as surveillance concerns heat up globally.

While June has historically been a tough month for crypto (Bitcoin averages -0.35% returns and Ethereum a painful -7.45% drop), these five cryptocurrencies have enough catalysts and technical strength to potentially buck the seasonal trend. Whether you're looking at technical upgrades, chart patterns, or unique value propositions, BNB, DOT, PEPE, SOL, and XMR each offer compelling reasons to consider a June entry.

Peter Smith

Peter Smith

Peter Smith

Peter Smith