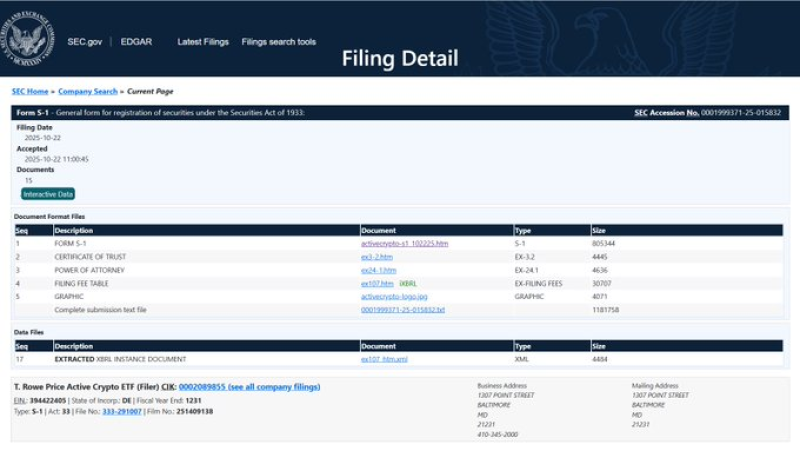

⬤ T. Rowe Price has officially submitted paperwork to the SEC for the "T. Rowe Price Active Crypto ETF," according to documents on the SEC's EDGAR filing system. The Form S-1 registration, filed on October 22, 2025, shows the investment giant is moving forward with plans to launch a crypto fund that would give investors regulated access to digital assets.

⬤ The filing specifically mentions XRP as one of the crypto assets covered by the proposed ETF. The SEC's review timeline points to February 26 as a key decision date. What makes this filing stand out is T. Rowe Price's heavyweight status - the firm manages roughly $1.8 trillion in assets, giving this application serious credibility in traditional finance circles.

The filing matters because ETF approvals can expand how crypto exposure is packaged and distributed through traditional market infrastructure.

⬤ If the SEC gives the green light, this fund would join a growing list of crypto ETF options hitting the market. The development fits into a broader pattern of XRP-related ETF activity. Similar moves have been tracked recently, including XRP ETF decision due by February 26 as SEC reviews T. Rowe Price fund, 21Shares files amended XRP ETF with SEC, and Franklin Templeton signals imminent XRP ETF launch.

⬤ The SEC's decision on this filing could set the tone for how quickly other crypto ETF products make it through the regulatory process. With XRP explicitly named in an active ETF structure backed by a major asset manager, the outcome will likely influence short-term sentiment around XRP and signal how open regulators are to expanding crypto investment products beyond Bitcoin and Ethereum.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova