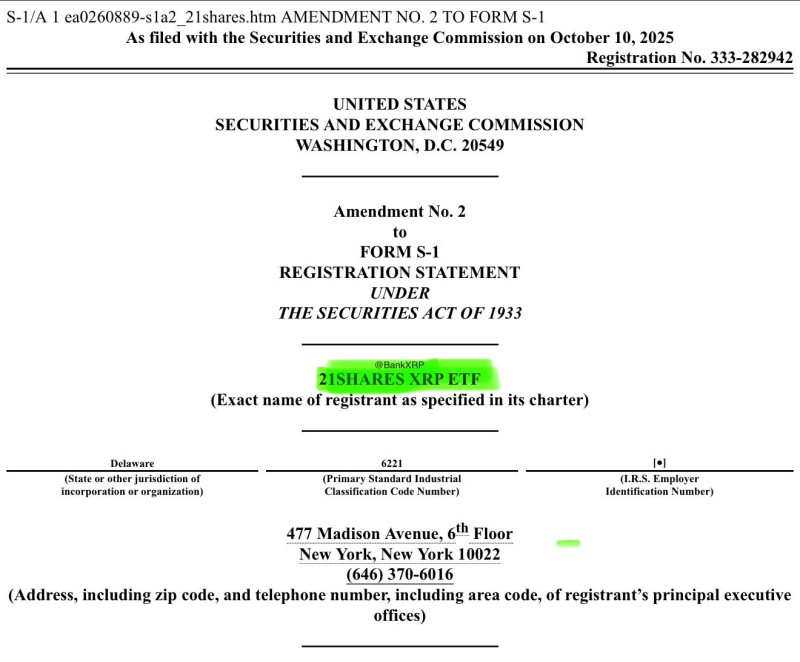

The crypto ETF landscape took another major step forward on October 10, 2025, when 21Shares filed Amendment No. 2 to its S-1 registration with the U.S. Securities and Exchange Commission. The amendment outlines plans for what could become the first XRP exchange-traded fund available to American investors.

A Landmark Filing for XRP

Trader BankXRP drew attention to the filing, explaining that the proposed fund would use the CME CF XRP Reference Rate as its pricing benchmark and would be listed on the Cboe BZX Exchange. The move represents a significant milestone for XRP, which has spent years navigating regulatory challenges in the United States.

The filing includes several notable components: 21Shares as the issuer brings its established track record in crypto exchange-traded products, the fund structure is designed to offer XRP price exposure without requiring investors to hold the token directly, the CME CF XRP Reference Rate provides an institutional-grade pricing mechanism, and Cboe BZX offers a proven platform that already hosts several crypto ETFs.

Why This Matters

Following the approvals of Bitcoin and Ethereum ETFs, the XRP proposal reflects the market's ongoing appetite for regulated digital asset products. For a token that has faced considerable regulatory scrutiny, this filing suggests XRP may be gaining acceptance as a legitimate investment vehicle.

The potential implications are substantial: regulated channels could open XRP to institutional investors who have remained on the sidelines, the ETF structure may drive greater liquidity and attract fresh capital into the XRP market, and the filing itself strengthens XRP's positioning as more than just a payments-focused cryptocurrency.

Price Implications

Previous ETF approvals for other digital assets have often sparked notable price movements. For XRP, the technical picture shows resistance clustering around $0.90 to $1.00, which has historically capped rallies, while support near $0.75 has provided a floor during pullbacks. An approval could act as a near-term catalyst similar to what Bitcoin and Ethereum experienced, though the magnitude would depend on broader market conditions and institutional demand.

Usman Salis

Usman Salis

Usman Salis

Usman Salis