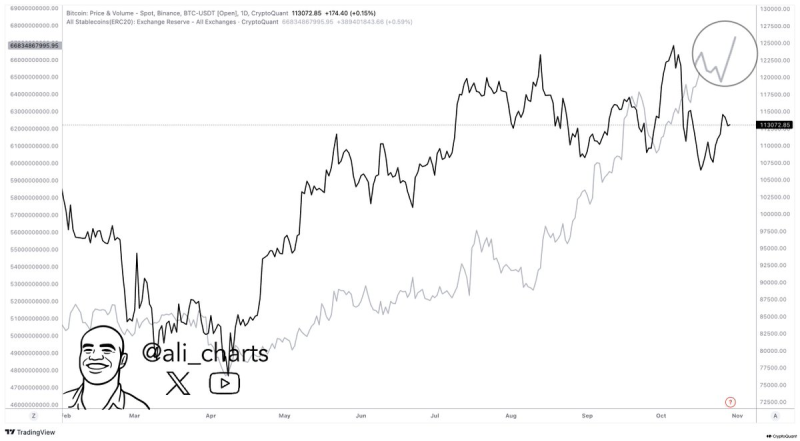

● Crypto analyst Ali recently pointed out that stablecoin reserves across exchanges have jumped by about $1 billion, based on CryptoQuant data. This shift shows investors are pulling back from riskier cryptocurrencies and parking funds in stablecoins—a classic defensive move during uncertain times.

● This trend hints at growing caution in the crypto space. When traders pile into stablecoins, less money stays active in spot markets, which can make assets like Bitcoin and Ethereum more volatile. Exchanges face lower trading volumes and thinner order books, potentially squeezing smaller platforms and pushing talent toward more stable industries during downturns. Historically, spikes in stablecoin reserves have often come before major market corrections or consolidation periods.

● The capital rotation also has broader economic effects. Reduced trading activity means fewer taxable gains, which cuts into government revenue from profit and capital gains taxes. Some experts suggest that instead of tighter regulations, governments could adjust tax structures to keep revenue flowing without discouraging market participation—preserving both liquidity and innovation.

● The $1 billion surge may reflect traders bracing for macroeconomic or regulatory headwinds as year-end approaches. Holding stablecoins gives investors the flexibility to jump back in quickly when conditions improve. But for now, the message is clear: consolidation mode. Extended stagnation could impact employment across trading, research, and exchange operations, further reducing tax revenue.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova