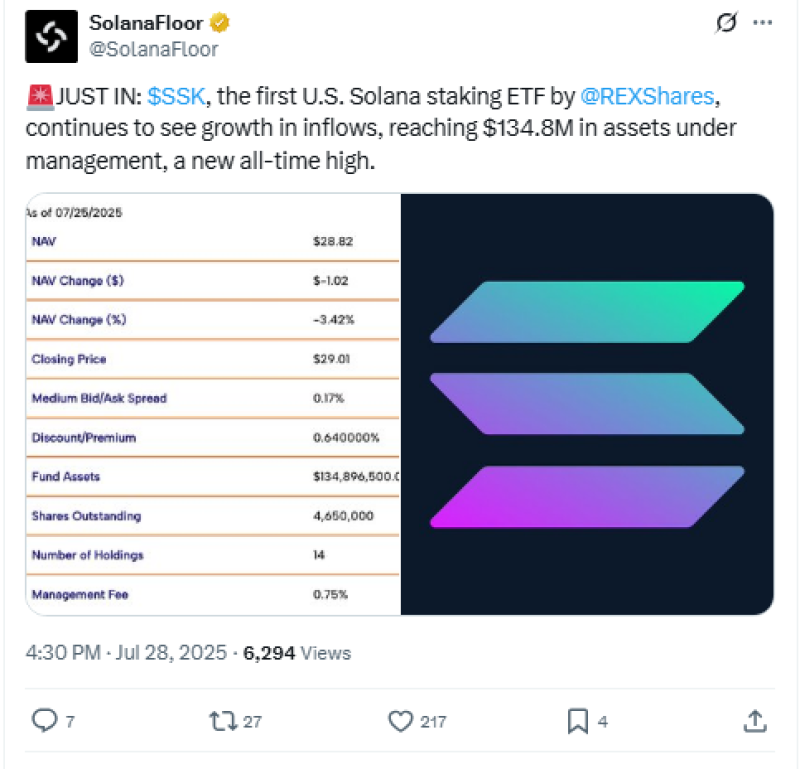

Solana's been crushing it lately, up 20.6% in the past month. The REX-Osprey SOL + Staking ETF has already pulled in $134 million since launching this month, and analysts think this is just the start.

This isn't your typical ETF – it stakes SOL tokens and passes rewards to investors through higher fund values. While SOL's been struggling to stay above $200, the U.S. ETF approval might be what it needs to break through.

Why Solana (SOL) Price Beats XRP for Smart Money

Matt Hougan from Bitwise and Bloomberg's James Seyffart both think Solana ETFs will outperform XRP ones, despite XRP's retail following.

"From conversations I've had, more serious investors and institutional players lean towards Solana and Ethereum. That's not to say there aren't institutional people looking at XRP, but interest tilts more toward Solana," Hougan said.

When institutional money picks favorites, prices usually follow. The staking feature makes SOL ETFs even more attractive – you get price exposure plus rewards.

Solana (SOL) Price Targets: $245 Soon, $500 This Year?

SOL hit selling pressure around $206 recently because the RSI showed overbought conditions. This pullback could be healthy – many think SOL might drop to around $170 to build steam for the next move.

If SOL breaks through $208, we could see a run to $245 quickly. But here's the kicker – some analysts are talking about $500 this year. With pro-crypto laws like the Genius Act and Clarity Act moving forward, plus growing ETF assets, that ambitious target might not be so crazy after all.

Usman Salis

Usman Salis

Usman Salis

Usman Salis