Solana has captured significant market attention as its price broke through the critical $210 resistance level, prompting one of the largest profit-taking events in recent months. This breakthrough represents more than just a price milestone—it reveals important insights about investor sentiment and market dynamics in the current crypto landscape.

Investors Cash Out as SOL Price Hits $210

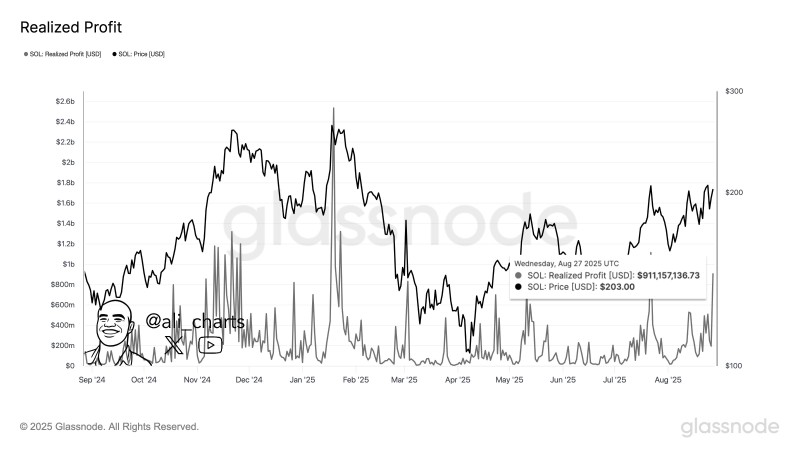

When Solana pushed above $210, it unleashed a wave of profit-taking that reached nearly $911 million according to on-chain data. This massive cash-out represents one of the biggest profit realization events SOL has seen in months.

Crypto analyst @ali_charts documented this correlation, showing how the price rally directly triggered the profit-taking surge. The data reveals that many traders had been waiting for this specific level to secure their gains.

Why Solana's Price Rally Matters

Breaking $210 isn't just about hitting a round number—it signals renewed bullish momentum for SOL after its recovery from earlier market corrections. However, the simultaneous profit-taking shows traders remain cautious, locking in gains amid ongoing market volatility.

Currently trading around $203, SOL is consolidating after its strong upward move. If the momentum continues, analysts project potential targets between $230-$250. But if profit-taking accelerates, SOL might retreat to the $180 support level before attempting another breakout.

The profit-taking wave reflects a market that's both optimistic and prudent. Solana's strong fundamentals—including fast transaction processing, expanding DeFi ecosystem, and growing institutional interest—provide solid bullish support.

The key question now is whether the $200 level can serve as a reliable foundation for SOL's next upward leg. Traders will be watching closely to see if this zone holds or if further consolidation is needed before the next major move.

Usman Salis

Usman Salis

Usman Salis

Usman Salis