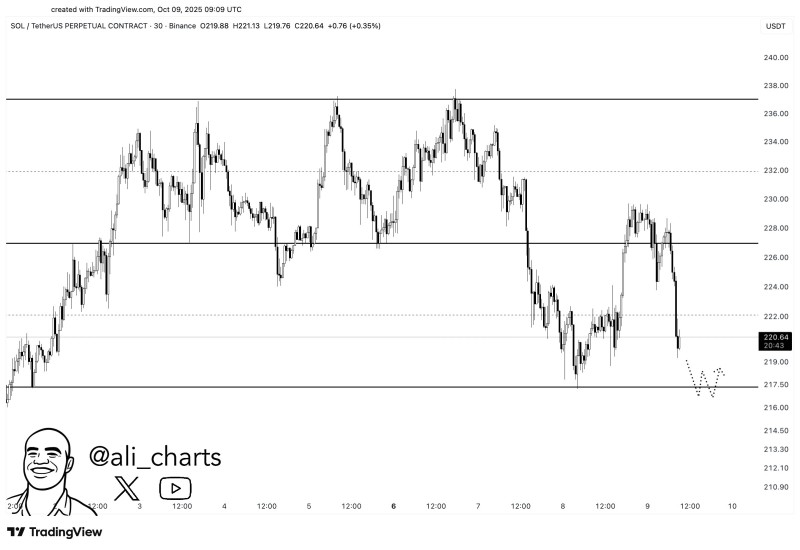

The crypto market remains volatile, and Solana is feeling the pressure. After pulling back sharply from $230, Solana (SOL) is now testing a crucial price level that traders are watching closely. The question on everyone's mind: will $217 hold, or are we headed lower?

Why $217 Is Make-or-Break

Market analyst Ali recently highlighted that $217 represents a pivotal threshold for Solana's near-term trajectory.

The technical setup suggests this level acts as a foundation for potential recovery, with chart patterns hinting at a possible W-shaped bounce if buyers step in to defend this zone.

What the Chart Reveals

The current price action shows Solana at an inflection point. The $217 area serves as the main line of defense - if it holds, short-term bulls could regain control and push prices higher. Above current levels, the $226–$228 range has acted as stubborn resistance where SOL repeatedly failed to break through. Beyond that, a more significant barrier sits around $236–$238, which remains the next major upside target. The sharp decline from above $230 reflects weakening momentum, though the cluster of support near $217 offers some hope for stabilization.

Broader Market Context

Solana's price isn't moving in isolation. The token is influenced by renewed interest in layer-1 blockchains that compete with Ethereum, the continued growth of Solana's DeFi and NFT ecosystems, and overall crypto market sentiment. Liquidity rotation between Bitcoin and altcoins can heavily impact how SOL performs in the short term.

What Traders Should Watch

The next few sessions are critical. If Solana holds $217 and manages to reclaim $226, we could see a move toward $236 and potentially higher. On the flip side, if $217 fails to hold, deeper losses may follow with $210 becoming the next area of interest.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah