Solana's in a weird spot right now. After hitting $206 earlier this month, SOL crashed back down and is now stuck around $180. You'd think people would be shorting after that kind of drop, but nope – retail traders are actually loading up on more longs.

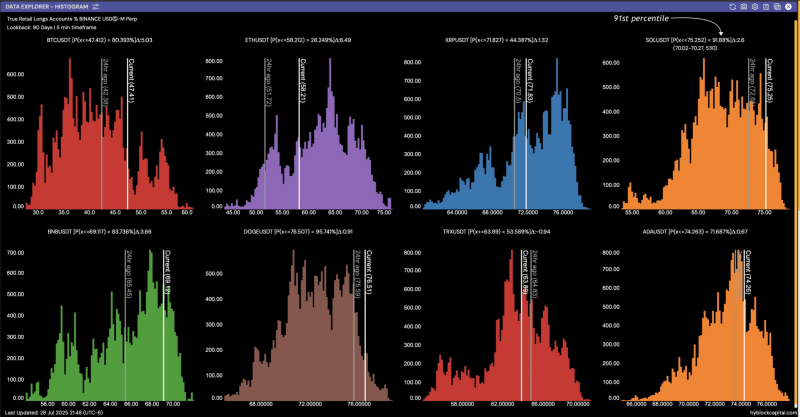

The data's pretty wild. SOL's retail long positioning just jumped to the 91st percentile, shooting up from 72.68 to 75.25 in just one day. That's a huge spike in bullish bets, and when retail gets this crowded on one side, things usually get messy fast.

What's crazy is how different SOL looks compared to everything else. While Solana longs are getting packed, Ethereum barely moved – only going from 57.12 to 58.21, which puts it in the 28th percentile. So all the action is happening with SOL right now.

SOL Sits on Edge at Critical $180 Level

Here's where it gets interesting. SOL is bumping up against resistance right at $180, and traders already unwound nearly 80% of their long positions in the last 24 hours. But instead of staying away, retail's jumping right back in with fresh longs. That makes the whole thing feel pretty top-heavy.

There's about $11 million worth of leveraged positions sitting around $183.30. If SOL breaks through that, it could easily push past $185 as shorts get caught off guard. But that's a big "if" right now.

The charts are sending mixed signals too. SOL's had three straight red daily closes, with the latest dip hitting $178. But open interest kept climbing during that pullback, which means people are still betting on higher prices. Either they're seeing something smart, or they're about to get burned.

The funding rate also flipped from -0.16% to slightly positive at 0.0079%, showing traders switched from betting against SOL to betting on it.

SOL Price Could Hit $190 if the Setup Clears

The big question now is what happens to all these retail longs. If positioning starts cooling off while SOL holds steady or creeps higher, that's actually good news. It means longs are taking profits into strength, which clears out the weak hands and sets up late shorts for a squeeze.

If those shorts get caught, $190 becomes the next target pretty quick. But if retail keeps piling in and the price can't break resistance, we might see another flush that wipes out those leveraged positions around $183.30.

The whole thing feels coiled up and ready to explode. With retail so loaded up on longs and resistance sitting right there, something's gotta give. Either bulls push through and trigger a squeeze toward $190, or all that crowded positioning becomes dead weight that drags SOL back down.

Bottom line: SOL's at a make-or-break moment. The next few days will show if retail traders called it right or if they're about to learn why crowded trades usually don't end well. With $11 million in leveraged bets hanging around $183.30, whatever happens next is probably gonna be pretty dramatic.

Usman Salis

Usman Salis

Usman Salis

Usman Salis