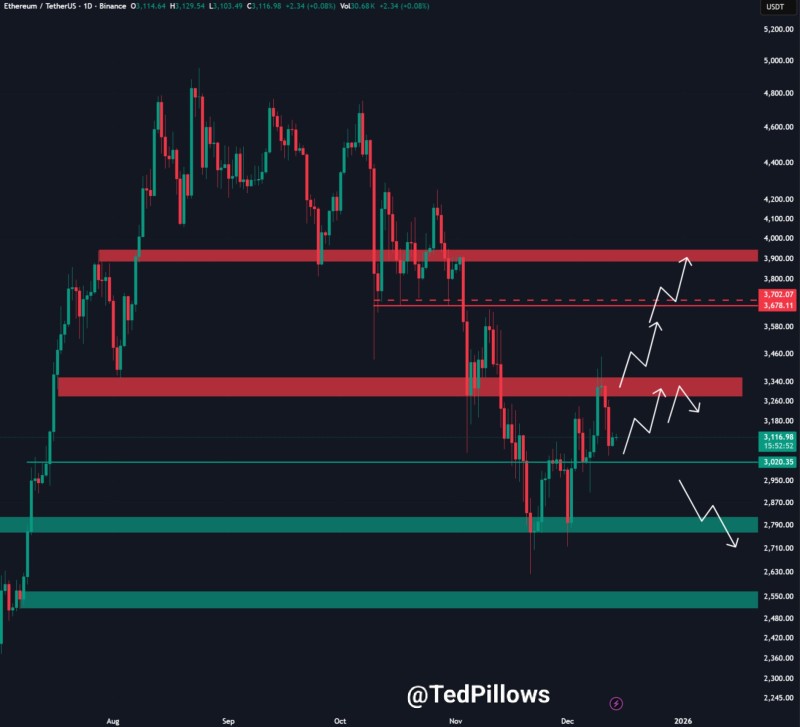

⬤ Ethereum is stuck in a consolidation pattern after recent price swings, with the action stabilizing below a critical resistance zone. ETH has been moving sideways, unable to push past the $3,400 mark—a level that's become increasingly important. The daily chart shows Ethereum hovering near $3,100 after bouncing from earlier support but struggling to maintain any upward momentum.

⬤ The chart reveals a broader resistance band between $3,800 and $3,900, where previous rallies ran into heavy selling. Just below that sits $3,400—a zone that used to provide support but has now flipped into resistance. Multiple breakout attempts have failed here, making it clear this level matters. Until Ethereum breaks convincingly above $3,400, further gains look unlikely.

⬤ Below current prices, a well-defined demand zone appears around $3,000, matching up with previous consolidation and liquidity pockets. If the price can't hold the $3,200–$3,250 area, there's a good chance we'll see a retest of $3,000. Deeper support levels are marked around $2,800–$2,700, though there's no immediate momentum pushing prices that low yet.

⬤ This sideways trading matters beyond Ethereum itself—ETH often sets the tone for the broader crypto market. A clean break above $3,400 would signal improving market structure and ease downside concerns. But continued rejection keeps those lower support zones in play. How Ethereum resolves this range could shape near-term volatility and trader sentiment across digital assets as everyone waits for clearer direction.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir