Ethereum (ETH) has shown a consistent pattern throughout 2025: periods of sideways movement, sudden drops to test key support levels, followed by explosive moves higher. The recent dip to the $4,000 zone has many wondering if we're seeing the final shakeout before the next major rally.

Ethereum's Recurring Pattern

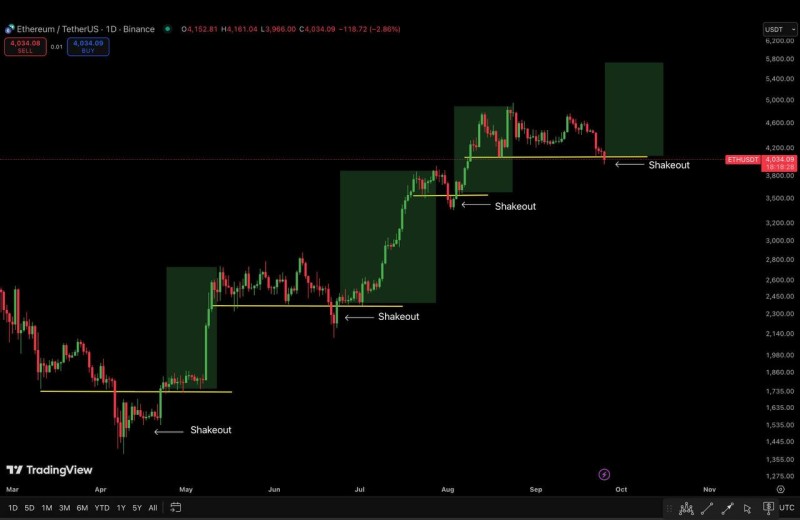

This year's price action reveals a clear three-stage cycle. First comes consolidation, where the market trades sideways in a defined range. Then a shakeout occurs - a sharp drop below important support that forces out weak holders and creates panic. According to Byte Drift trader analysis, this is typically followed by a parabolic pump, where strong rallies push prices to new highs once support proves solid. Ethereum's current movement fits this exact framework, suggesting the present shakeout might trigger the next breakout phase.

The $4,000 level has become crucial support, serving as the launching pad for previous rallies. Each shakeout since May has consistently led to strong upward breakouts. If the pattern continues, we could see a move toward the $5,500–$6,000 range. However, a clean break below $3,800 would invalidate this bullish setup.

Market Fundamentals

Several factors support Ethereum's positive outlook. ETH staking continues reducing the available supply for trading, creating natural scarcity. Institutional interest keeps growing through ETFs and investment funds. Additionally, improving macroeconomic conditions could boost appetite for risk assets like crypto.

Peter Smith

Peter Smith

Peter Smith

Peter Smith