Ethereum (ETH) price action is heating up as it trades near a crucial inflection point. With ETH hovering just below $4,300, all eyes are on the $4,500 level where massive short positions could face liquidation. This setup creates the perfect storm for what traders call a "short squeeze" – a rapid price surge driven by forced buying as leveraged positions get wiped out.

Ethereum Price Poised for Explosive Move

Ethereum sits at a crossroads, trading just under $4,300 while the crypto community watches the $4,500 mark with anticipation.

Famous analyst points to liquidation data revealing billions in leveraged short positions stacked above current price levels, creating a powder keg situation.

The mechanics are simple but powerful: if ETH pushes through resistance, these short positions will be forced to buy back, potentially creating a self-reinforcing cycle that drives prices dramatically higher.

Critical Liquidation Levels Show Mounting Pressure

The numbers tell a compelling story about what's brewing beneath the surface:

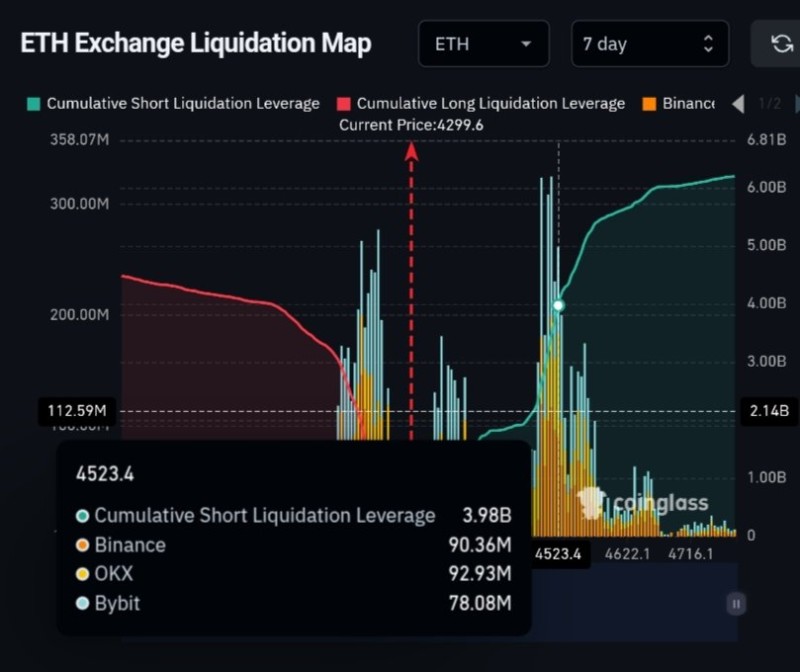

- Nearly $4 billion in cumulative short liquidations clustered around $4,523

- Major exchange exposure with Binance holding $90.36M, OKX $92.93M, and Bybit $78.08M in potential liquidations

- Rising funding rates indicating increasingly aggressive short positioning

- Heavy trading volume concentrated near the $4,500 breakout zone

This data suggests shorts have become dangerously overextended. A single strong upward move could trigger a domino effect of forced buying.

Why $4,500 Could Spark a Major Rally

The $4,500 level represents more than technical resistance – it's the match that could light the fuse. If Ethereum breaks through this barrier, the resulting short squeeze could propel ETH toward $4,700-$4,800 in short order.

The broader market context adds fuel to the fire. Altcoin momentum is building, and if a squeeze materializes, ETH could see its market dominance expand. History shows these events often cascade across the entire crypto ecosystem.

Market Dynamics Point to Potential Breakout

Several factors are aligning to support a bullish scenario. The concentration of short positions creates an asymmetric risk-reward setup where buyers have limited downside but massive upside potential. Meanwhile, increasing institutional interest and improving market sentiment provide the fundamental backdrop for sustained upward movement.

The key now is whether buyers can generate enough momentum to crack the $4,500 ceiling and unleash the liquidation cascade waiting above.

Peter Smith

Peter Smith

Peter Smith

Peter Smith