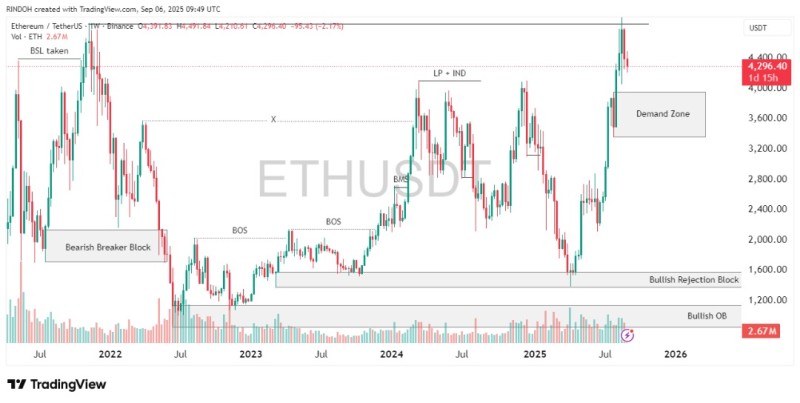

Ethereum (ETH) recent price action has captured traders' attention as the cryptocurrency navigates a crucial technical juncture. After hitting resistance near $4,400, ETH has pulled back to test a key support zone that could determine its next major directional move. The current consolidation phase presents both opportunities and risks for market participants.

ETH Price Action: Pullback After $4,400

Ethereum recently touched the $4,400 resistance level before experiencing a swift rejection that swept liquidity from the highs. The cryptocurrency is now trading around $4,296, finding support within a well-defined demand zone spanning $3,800 to $4,000.

Trader identifies this area as critical for ETH's near-term trajectory.

His analysis suggests that successful defense of this zone could pave the way for another attempt at breaking through overhead resistance levels.

ETH Demand Zone: Key for Bullish Continuation

The $3,800–$4,000 range has emerged as a significant accumulation zone for buyers. A strong bounce from this level could propel ETH back toward the $4,400 resistance, with potential for further gains into the $4,500+ territory.

However, if this support fails to hold, ETH could face deeper selling pressure with the next major support level around $3,600. Despite this risk, the overall market structure remains constructive, with multiple Break of Structure (BOS) signals indicating continued bullish momentum.

Critical Price Levels to Monitor

Several key levels will determine ETH's next move. Immediate resistance sits at $4,400, while the current demand zone between $3,800–$4,000 serves as crucial support. Bulls are targeting a move above $4,500, but a breakdown could see prices test $3,600.

Market Sentiment and Momentum Indicators

The broader altcoin market is showing signs of strength, which could provide additional support for Ethereum's price action. Trading volumes and momentum indicators suggest that despite the recent pullback, underlying demand remains robust.

Ethereum Price Outlook: What to Watch Next

- Immediate Resistance: $4,400

- Demand Zone: $3,800–$4,000

- Bullish Target: $4,500+

- Critical Support: $3,600

Ethereum's ability to maintain the current demand zone will likely dictate its short-term direction. With strong liquidity levels and positive sentiment in the altcoin sector, ETH remains well-positioned for another upward leg if key support levels hold firm

Peter Smith

Peter Smith

Peter Smith

Peter Smith