Ethereum (ETH) dream run to $5,000 just hit some serious turbulence. While everyone's been watching ETH hover around $4,542, there's drama unfolding behind the scenes that could make or break this rally.

Here's the thing – those diamond-handed long-term holders who've been sitting pretty since ETH's August highs? They're finally taking profits. And when these guys start selling, it's like watching dominoes fall. Meanwhile, futures traders are betting against ETH harder than they have in weeks.

The Smart Money Is Cashing Out on ETH

The numbers don't lie. ETH's Liveliness metric just hit a yearly peak of 0.704, according to Glassnode – and that's bad news for bulls. This metric basically tracks when old coins start moving, and right now, it's screaming that long-term holders are hitting the sell button.

Think of it this way: when Liveliness drops, it means hodlers are keeping their coins locked up, accumulating more. But when it spikes like this? Those same holders are taking their profits and running. After ETH's monster rally to all-time highs in August, you can't really blame them.

But here's the kicker – this selling pressure is exactly what's keeping ETH from breaking through to that magical $5,000 level. It's like trying to drive uphill with the handbrake on.

Ethereum (ETH) Futures Traders Are Betting Against the Rally

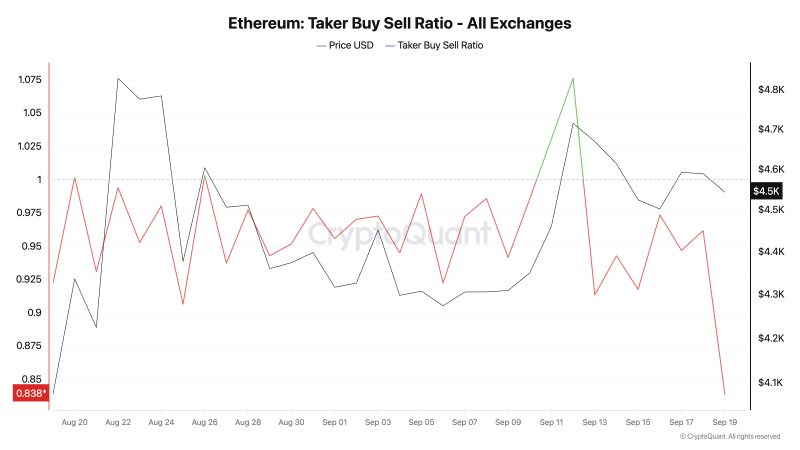

If the long-term holder selloff wasn't enough, futures traders are piling on the bearish sentiment. CryptoQuant data shows ETH's taker buy-sell ratio has been stuck below 1.0 for weeks – and that's a red flag you can't ignore.

Here's what this means in plain English: when this ratio drops below one, it's like having more people trying to exit a burning building than entering it. Traders are betting against ETH, and they've been doing it consistently for over a month.

This bearish positioning in the derivatives market is creating a perfect storm with the long-term holder exits. It's not just retail getting spooked – even the pros are backing away from ETH's rally to $5,000.

What's Next for ETH Price Prediction?

Right now, ETH is sitting at $4,542, still holding that crucial $4,211 support level. But if the selling pressure keeps mounting, we could see a test of that floor – and if it breaks, things could get ugly fast with a potential drop to $3,626.

The bulls aren't completely out of the game though. If demand suddenly picks up (maybe from some positive Ethereum ecosystem news or a broader crypto market rally), ETH could make a run at the $4,957 resistance. Break through that, and suddenly $5,000 doesn't look so far away.

Peter Smith

Peter Smith

Peter Smith

Peter Smith