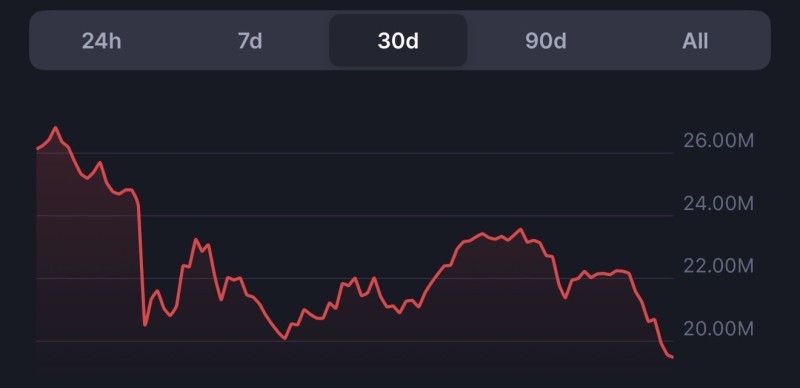

Ethereum took a beating on Monday, wiping out weeks of gains in a single session. The world's second-largest cryptocurrency plunged more than $360, breaking below the 200-day moving average—a critical trendline that institutional traders watch closely. The selloff pushed ETH down to $3,240 by mid-afternoon EST, down over 10% from the previous close of $3,602.

What Happened?

Market analyst Wall St Engine called it a "crucial psychological moment" for traders who were counting on that level to hold.

The breakdown didn't happen in one panic-driven spike—it was a steady, relentless slide throughout the day. ETH started around $3,600 but quickly lost ground as selling pressure mounted. By morning, it briefly steadied near $3,300 before continuing lower. The chart shows a smooth downward curve, suggesting broad-based selling rather than just a few whales dumping.

Breaking below the 200-day moving average is a big deal. It's often the line between bullish and bearish territory, and once it's breached, it tends to trigger algorithmic sell signals and stop-loss cascades—exactly what we saw here.

Several factors are weighing on ETH right now:

- Profit-taking: After rallying above $3,700 in October, traders are locking in gains

- Weaker on-chain activity: Lower gas fees and fewer transactions signal softer demand

- Capital rotation: Institutional money is flowing back into Bitcoin ETFs

- Macro headwinds: A stronger dollar and higher Treasury yields are pressuring all risk assets

None of this is happening in a vacuum—broader crypto and equity markets are cooling off as investors get cautious about the economic outlook.

What Analysts Are Saying

This breach of the 200-day average is "a crucial inflection point" for Ethereum's medium-term trend. He notes that while short-term pain may continue, the long-term structure is still intact as long as ETH stays above $3,000–$3,100. Reclaiming $3,400 would be the first sign of stabilization and could set the stage for a recovery later this month.

The key levels to watch are $3,400 (recovery pivot), $3,200 (current support), and $3,000 (major support zone last tested in summer 2024). If ETH can't hold $3,000, we could see a drop toward $2,800. Despite the drop, long-term investors see this as a potential buying opportunity, especially with Ethereum's upcoming network upgrades and its dominance in DeFi. But sentiment is fragile right now—the next few days will tell us whether this is just a shakeout or something deeper.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah