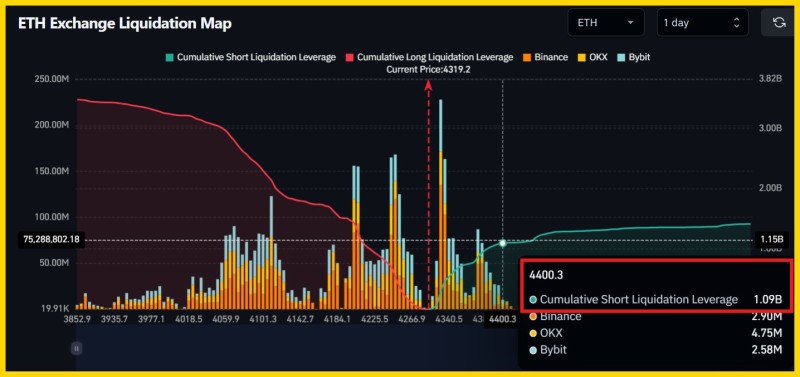

Ethereum (ETH) is currently trading around $4,319, caught between two massive liquidation walls that could determine its next major move. With over $1 billion in short positions vulnerable above $4,400 and nearly $1.5 billion in longs at risk below $4,200, the market is primed for a sharp breakout.

Liquidation Walls Tighten Around ETH

According to CryptoNinjas Trading, the latest exchange liquidation data reveals a dangerous concentration of leveraged positions around these key levels.

Shorts are sitting on roughly $1.09 billion in exposure above $4,400, while longs face $1.47 billion in potential liquidations below $4,200. Trading volume has spiked between $4,250 and $4,350, showing that traders are aggressively positioning despite the risks.

What This Means for the Market

This standoff comes as crypto markets balance between consolidation and breakout mode. While Bitcoin's sideways movement has kept overall volatility contained, Ethereum's leveraged exposure is creating a powder keg scenario. Even a modest push could set off a chain reaction of liquidations. A rally above $4,400 would likely force short sellers to cover, potentially fueling a bullish surge. Conversely, a drop below $4,200 could trigger panic selling among overleveraged longs, opening the door to steeper declines. For traders watching ETH right now, this isn't a quiet consolidation - it's a loaded spring waiting to release.

Usman Salis

Usman Salis

Usman Salis

Usman Salis