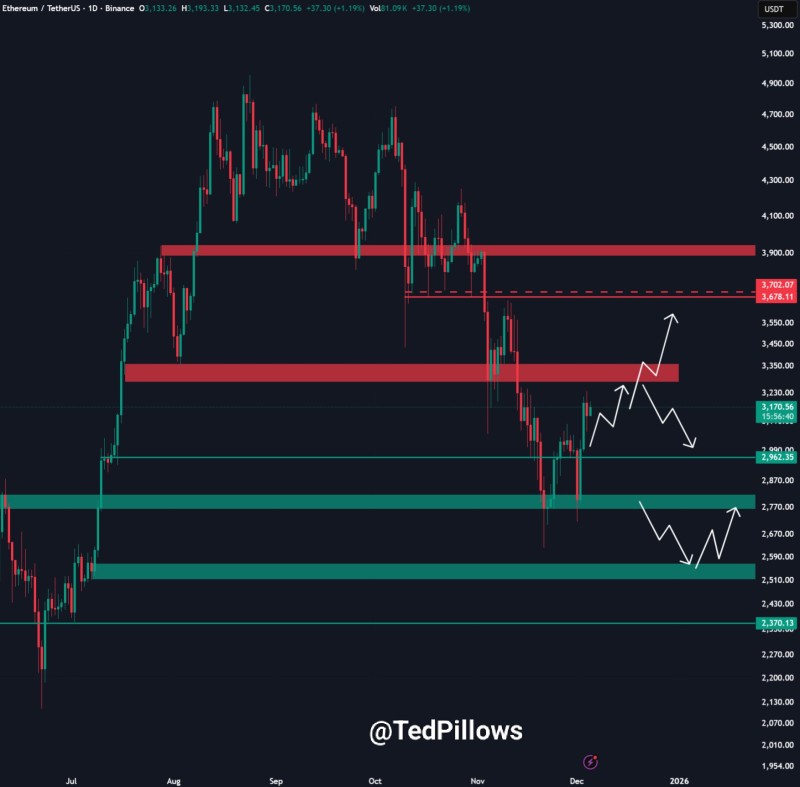

⬤ Ethereum pushed higher on Thursday, getting closer to a resistance zone that's stopped previous rallies in their tracks. Trading around $3,170 in recent sessions, ETH is now testing the $3,300–$3,400 range—a level that's proven to be a tough barrier for bulls. The recent climb follows a recovery from lower support levels, with steady momentum building as the asset approaches this critical area.

⬤ Breaking above the $3,300–$3,400 zone would signal renewed strength for Ethereum in the near term. The chart shows ETH consolidating just below this resistance cluster, where selling pressure has repeatedly kicked in. If buyers can push through with solid volume backing the move, it could shift the market structure and open the door for further gains.

⬤ On the flip side, there's real risk if ETH gets rejected at resistance. A failure to break through would likely send the price back down to retest the $3,000 area, with additional support sitting around $2,900 and $2,770. These lower levels could attract buyers looking for a better entry if Ethereum shows weakness in the coming sessions.

⬤ What happens around these key levels matters beyond just ETH—it could influence sentiment across the broader altcoin market. A clean breakout above resistance would reinforce improving momentum and potentially spark renewed interest in major altcoins. But another rejection would keep Ethereum trapped in its multi-week range and signal that caution is still warranted. Traders are watching closely to see which way ETH breaks.

Usman Salis

Usman Salis

Usman Salis

Usman Salis