Something interesting is happening with Ethereum right now. While most traders are focused on Bitcoin's moves, ETH has quietly assembled two powerful groups backing its breakout – and they're pointing toward a massive $5,100 target.

ETH Breaks Out While Everyone's Looking Away

Ethereum hit $4,540 on September 12, climbing 3% in 24 hours and nearly 5% for the week. The breakout happened on September 10 when ETH escaped a falling wedge pattern that had been squeezing the price for weeks.

What makes this move special isn't just the technical setup – it's who's behind it. Long-term holders aren't selling (unusual during rallies), and derivatives traders are going all-in with bullish bets. When these two forces align, things get explosive.

The Data That Changes Everything for ETH

Here's where it gets interesting. Usually when Ethereum rallies, old-timers cash out. Not this time.

Coins being moved dropped 64.5% between September 4-12 – from 417,000 ETH down to just 148,000 ETH. Earlier summer rallies saw over 500,000 ETH hit the market every time price spiked. The smart money isn't selling – that's a massive vote of confidence.

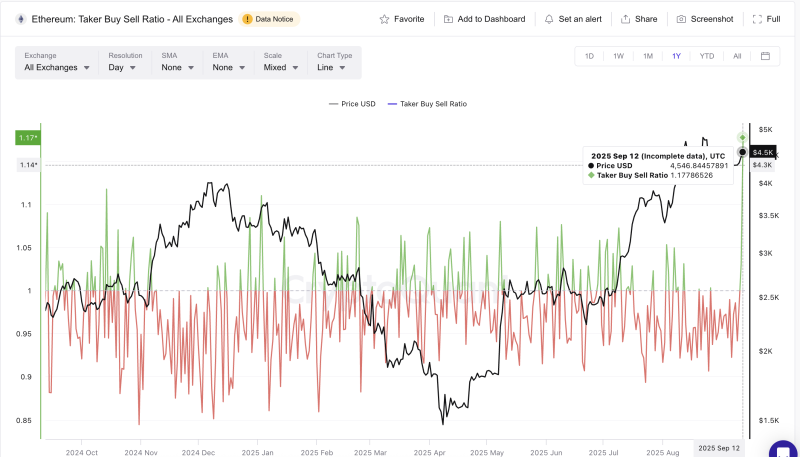

Meanwhile, derivatives traders are having a field day. The Taker Buy/Sell Ratio shot up to 1.17 – highest in over a year. Last time we saw this aggressive buying, ETH rocketed from $3,490 to $4,750 in weeks (36% gain).

You've got holders refusing to sell and speculators piling in. It's rocket fuel.

Why $5,100 Isn't Wishful Thinking for ETH

The $5,100 target comes from the falling wedge breakout math. You measure the wedge's height and project it from the breakout point – landing around $5,110, about 12% higher than current levels.

ETH needs to punch through resistance at $4,630, $4,790, and the previous peak of $4,950. But with holders staying put and traders pushing aggressively, it has the fuel to power through.

The risk? If ETH drops below $4,279, this breakout gets invalidated. Below $4,060 turns genuinely bearish. But given current data, those scenarios look unlikely.

Peter Smith

Peter Smith

Peter Smith

Peter Smith