Ethereum is sitting on a powder keg. With ETH trading near $4,618 and billions in short positions hanging in the balance, the stage is set for what could be one of crypto's most explosive moves. Market data reveals that a simple retest of Ethereum's all-time high could trigger liquidations worth more than many countries' GDP.

ETH Price Faces Massive Liquidation Risk

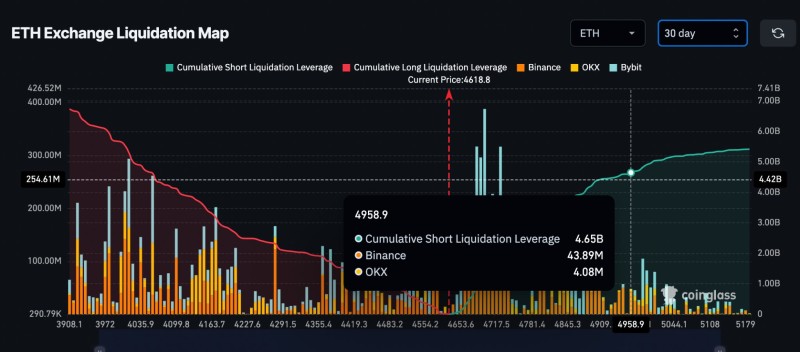

Ethereum is back in the spotlight as it hovers dangerously close to levels that could unleash chaos in the derivatives market. Trading at $4,618, ETH needs just a 7% push to reach its previous all-time high of $4,958 – a move that would instantly put $4.65 billion worth of short positions underwater.

The numbers are staggering. According to a report highlighted by @Cointelegraph of liquidation maps, bearish traders have piled into short positions with unprecedented leverage. This creates a classic squeeze scenario where forced buybacks could send ETH rocketing past the psychological $5,000 barrier in a matter of hours.

The liquidation risk isn't spread evenly across the market. Major exchanges are sitting on massive short position clusters, with Binance holding $43.89 million in potential liquidations and OKX another $4.08 million. These concentrated positions act like dominos – once they start falling, the cascade effect becomes unstoppable.

What's particularly striking is the $4.42 billion in cumulative short leverage already built up in the system. This represents an enormous bet against ETH that could backfire spectacularly if bulls can push through resistance.

The Road to $5K

History suggests that when liquidation pressure reaches these levels, breakouts tend to be violent and swift. If ETH can punch through its previous high, the next logical target sits around $5,000-$5,200 – a zone that would confirm the bulls are firmly back in control.

For long-term holders, this setup looks increasingly bullish. The sheer weight of short positions suggests that any upward momentum could be amplified dramatically. But traders should stay alert – the same leverage that could fuel a moonshot can just as easily trigger brutal volatility in both directions before new highs are reached.

Peter Smith

Peter Smith

Peter Smith

Peter Smith