Dogecoin, one of crypto's most popular and community-backed assets, is experiencing fresh volatility as major holders dump 500 million DOGE within seven days. While the coin hovers around $0.20, this massive reduction in whale positions points to growing uncertainty among the big players who've historically driven DOGE's wild price swings.

Whale Movements Confirm Profit-Taking Trend

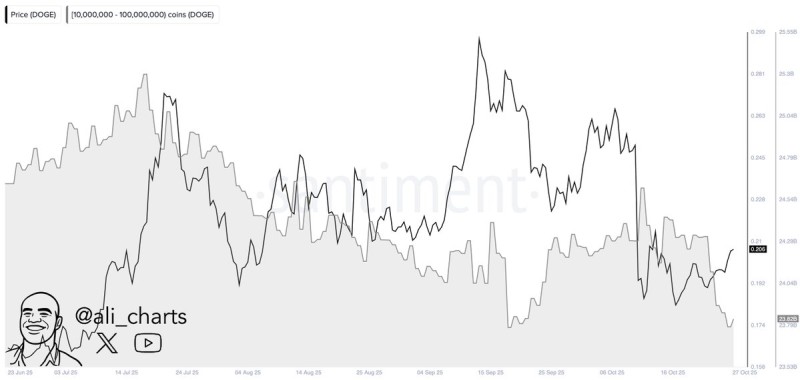

On-chain data from market analyst Ali using Santiment reveals a telling pattern. The chart tracks wallets holding between 10 million and 100 million DOGE against price movements, and the correlation is hard to miss. As whale balances dropped from late July through October, DOGE's price slid from roughly $0.28 down to about $0.20.

The heaviest sell-offs hit during mid-September and early October, right after local price peaks. Even when minor recoveries appeared in mid-October, each uptick was met with more distribution from large holders. This sustained outflow suggests whales are cashing out after Dogecoin's summer rally, possibly bracing for a broader market cooldown.

Possible Drivers Behind Whale Selling

Several factors might explain why big holders are backing off:

- Market consolidation as Bitcoin and Ethereum stall below key resistance, limiting altcoin momentum

- Fading hype with fewer Dogecoin updates or celebrity mentions lately

- Macro headwinds from lingering interest rate concerns and tighter liquidity making speculation riskier

That said, Dogecoin's strong brand recognition, loyal community, and ongoing integration efforts with platforms like X still support its long-term standing as crypto's top meme coin.

Key Support and Outlook

Technically speaking, $0.20 is the line in the sand. If DOGE holds above this level, traders might view the whale activity as temporary repositioning before fresh buying kicks in. But a clean break below $0.20 could push the price toward $0.17–$0.18, where buyers have historically stepped back in.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov