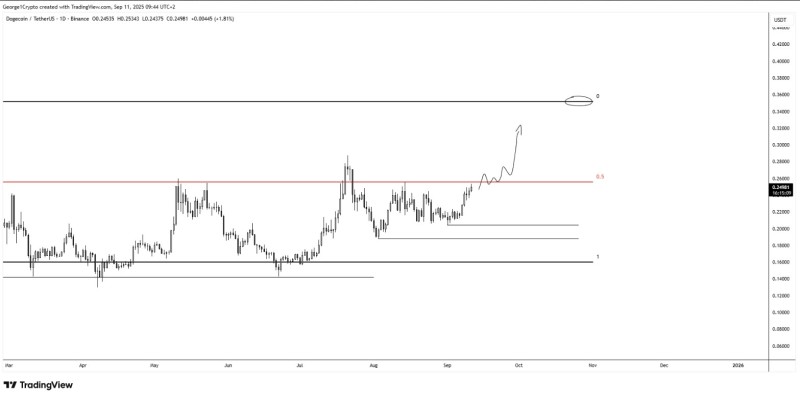

Dogecoin has finally done what bulls have been hoping for - a clean break above its mid-range resistance that opens the door to much higher prices. After grinding sideways for weeks, DOGE just cleared the $0.25 zone that had been keeping it locked down.

Key Technical Levels to Watch:

Trader George called it perfectly, noting the "clean break" above the weekly range mean that puts the meme coin back on track for a potential retest of its $0.35 highs.

- Current Price: $0.2498 (+1.81% daily gain)

- Next Target: $0.35 (previous range high)

- Support Zones: $0.22 (immediate) and $0.16 (deeper pullback protection)

- Critical Break: Clean push above $0.25 resistance zone

The chart shows a potential stair-step rally pattern, suggesting DOGE might consolidate briefly before making its next move higher. What's encouraging is how cleanly it broke through that red resistance zone - no messy back-and-forth, just a decisive push that signals real buying pressure.

Why DOGE Is Moving Now

This breakout isn't happening in a vacuum. Bitcoin's been holding steady around key levels, which typically gives traders confidence to rotate into higher-risk plays like DOGE. The meme coin has always been a momentum play, and when it breaks key technical levels like this, retail traders tend to pile in fast.

DOGE's community-driven nature means sentiment can shift quickly. Once the technicals align with some bullish narrative, the moves can be explosive. We're seeing early signs that both pieces might be coming together.

The Road to $0.35

If this breakout holds, the path to $0.35 looks pretty straightforward. That level represents the upper boundary of DOGE's recent trading range, and getting there would mean roughly a 40% gain from current levels. The key will be holding above that $0.25 level that just flipped from resistance to support.

Short-term pullbacks are always possible - nothing goes straight up. But as long as DOGE stays above its new support levels, the overall structure looks bullish. George mentioned he's holding spot rather than chasing new trades, which might be the smart play. Sometimes the best move is just letting winners run rather than trying to time every swing.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah