Bitcoin and Ethereum face a significant options expiry, totaling $2.4 billion in value. Will this impact market sentiment?

Bitcoin Options Expiry Analysis

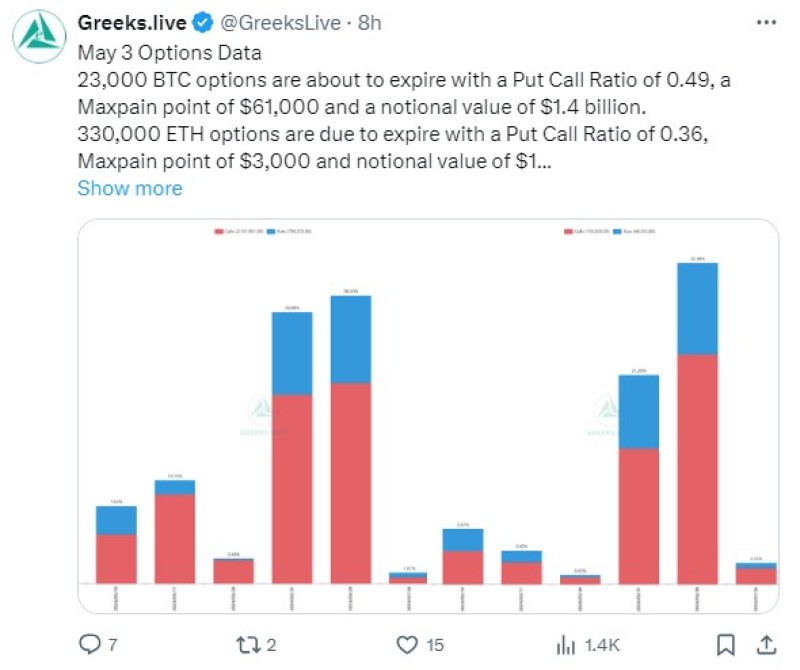

Today marks the expiration of approximately 23,000 Bitcoin options, valued at $1.4 billion. Despite similar figures in past events, market sentiment remains uncertain as Bitcoin hovers below $60,000, leading to a bearish outlook in the short term.

The put/call ratio stands at 0.49, indicating twice as many long contracts expiring compared to shorts. The max pain point for these options is $61,000, slightly above current spot prices, implying potential losses upon contract expiry.

Open Interest and Market Conditions

Deribit reports substantial open interest at strike prices above $70,000, with $661 million at the $100,000 strike. However, the likelihood of BTC reaching such levels in the short term appears slim amidst current market conditions.

In addition to Bitcoin, around 330,000 Ethereum options, valued at approximately $1 billion, are set to expire today, with a put/call ratio of 0.36 and a max pain point of $3,000, recently reclaimed.

Despite the uncertainty surrounding the options expiry, crypto markets experienced a modest recovery, with total capitalization rising by 4% to $2.35 trillion. Bitcoin saw a similar gain, reaching $59,600, albeit struggling to reclaim the $60,000 threshold. Ethereum surpassed $3,000 with a 3.7% increase, while altcoins like Solana, Dogecoin, Toncoin, Shiba Inu, and Polkadot posted notable gains, albeit after significant losses since the mid-March market peak.

Analysis of Market Confidence and Volatility

The recent launch of spot crypto ETFs in Hong Kong failed to significantly impact market volume, with US spot Bitcoin ETFs witnessing outflows amidst market weakness. Implied volatility, a measure of future expected volatility derived from expiring crypto derivatives contracts, continues to decline across major terms, reflecting a weakening market confidence.

In conclusion, as the $2.4 billion options expiry event unfolds, market participants closely monitor Bitcoin and Ethereum's performance amidst evolving sentiment and volatility levels, with recovery efforts underway but uncertainties persisting in the wake of recent market downturns.

Peter Smith

Peter Smith

Peter Smith

Peter Smith