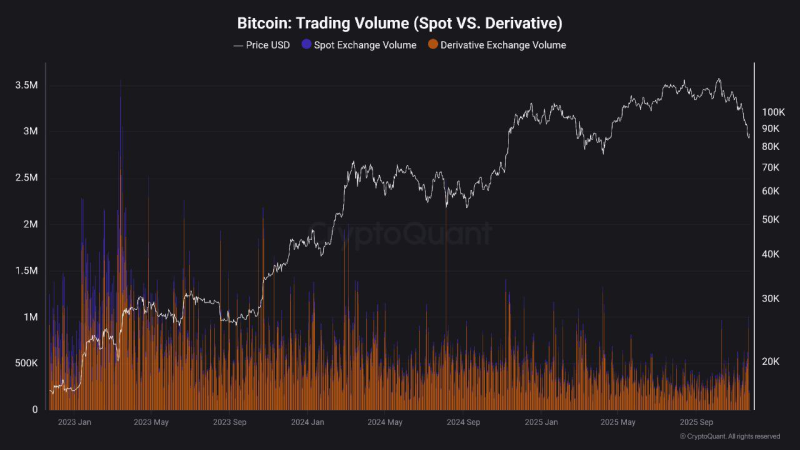

⬤ Bitcoin keeps changing hands above $85,000 - yet traders argue about what kind of rise this is. The latest move upward comes chiefly from futures bets, not from real coins bought in the spot market - doubts grow about how long the climb will last. Figures that set spot turnover beside derivative turnover show an even split - futures ruled trade through 2023, 2024 and into 2025 while BTC went from below $20,000 to above $85,000.

⬤ The same figures reveal the width of the gap. Derivative venues day after day record far larger turnover than spot venues, even on the strongest up-days and at local tops. Spot turnover stays subdued while Bitcoin posts its sharpest gains. BTC briefly traded above $90,000 in early 2025 before slipping back - yet that spike arrived without any visible lift in spot activity. The sequence signals that recent gains stem from leveraged bets rather than from fresh bids for actual coins.

⬤ Past cycles show the same script - rallies led by derivatives tend to unwind fast once leverage flips. Records list many cases in which heavy futures turnover came right before sharp declines proving BTC turns fragile when leverage dominates yet spot flows stay thin.

⬤ The market now reads Bitcoin's stance through this lens. High prices reveal hearty speculative appetite, but scant spot demand means BTC's next step depends more on leverage health and on liquidity than on new money entering the asset. Unless spot activity rises, Bitcoin's route upward will stay open to sudden jolts from futures rather than to calm, long term buying.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah