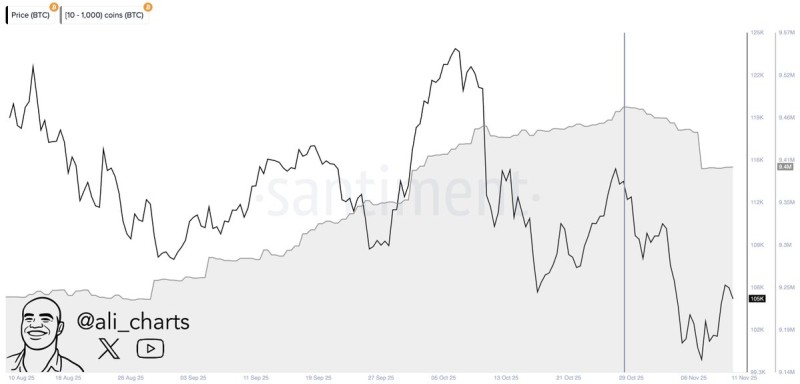

⬤ On-chain data shows a significant shift in Bitcoin whale behavior. Since late October, large holders have moved from accumulation mode into distribution, selling over 80,000 BTC. This marks a clear reversal after weeks of steady buying, suggesting that major players are pulling back amid growing market uncertainty.

⬤ Wallets holding between 10 and 1,000 BTC have reduced their combined holdings from roughly 9.52 million BTC to 9.41 million BTC since late October, according to Santiment data. Historically, whale distribution phases like this have often preceded short-term price corrections or consolidation periods, as coins move to exchanges and selling pressure builds.

⬤ The ongoing distribution trend carries near-term risks for Bitcoin's price. When whales start selling, it can fuel volatility, trigger stop-loss orders, and prompt retail traders to lock in profits. If this pattern continues, Bitcoin could test deeper support levels before bouncing back. That said, some analysts view redistribution as healthy—spreading coins to smaller wallets can reduce concentration risk and create a more balanced market over time.

⬤ Bitcoin is currently trading under pressure, consolidating below key resistance levels as whale accumulation fades. If large holders keep distributing, the next move will likely hinge on whether retail demand can absorb the supply. For now, whale behavior is one of the most critical signals to watch in Bitcoin's evolving price action.

Usman Salis

Usman Salis

Usman Salis

Usman Salis