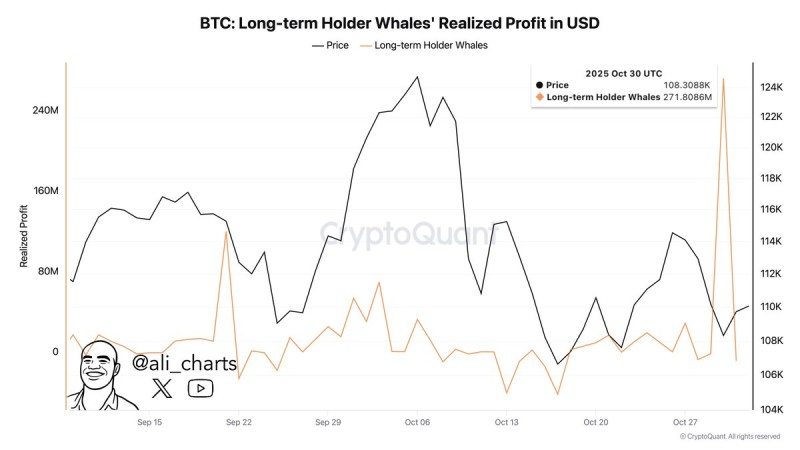

A major on-chain signal has caught traders' attention: Bitcoin's long-term holder whales have realized over $272 million in profits as of October 30, 2025. The move marks one of the largest profit-taking events in months, coming at a time when BTC's price remains near the $108,000 level — suggesting large holders are locking in gains without triggering a major selloff.

Whales Take Profits While Bitcoin Price Holds Firm

According to data shared by trader Ali, the chart shows Bitcoin's long-term holder whales' realized profit plotted against BTC price. Throughout September and October, realized profits moved modestly until a sharp surge at the end of October, hitting $271.8 million — a massive spike compared to previous weeks.

What's interesting is that despite this profit-taking wave, Bitcoin's price stayed relatively stable around $108K–$110K, showing that the market absorbed the selling pressure efficiently. This stability suggests strong underlying demand, likely from institutional participants or high-conviction retail investors who stepped in to buy.

What the Data Suggests About Market Sentiment

Historically, large realized profit events by whales can signal short-term cooling phases, as major holders secure gains after extended rallies. However, the absence of a price dip indicates the market remains structurally strong. Rather than exiting positions entirely, whales may be rebalancing portfolios or preparing liquidity for future entries. In previous cycles, similar spikes often coincided with mid-cycle consolidation rather than full-blown reversals.

Broader Context: Profit-Taking in a Maturing Market

This development comes amid renewed optimism in the crypto sector. Several key factors are supporting current sentiment:

- Expectations of U.S. monetary easing in early 2026

- Continued institutional accumulation via BTC ETFs and custody platforms

- Broader rotation back into risk assets as macro uncertainty eases

The fact that whales are realizing profits while maintaining overall exposure shows how Bitcoin is evolving into a more mature asset class — one where strategic profit management replaces panic selling. This behavior reflects a shift toward professional portfolio management rather than emotional trading.

Controlled Profit-Taking, Not a Market Top

The $272 million in realized profits shows that whales are monetizing gains strategically rather than exiting the market entirely. With BTC maintaining its range around $108,000, there's little evidence of large-scale distribution or panic-driven sell pressure. As long as Bitcoin continues holding above $105K, analysts expect consolidation to give way to renewed upward momentum later this quarter. The data paints a picture of smart money acting prudently, suggesting Bitcoin's long-term bullish structure remains firmly intact.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov