Bitcoin hit $123,000 and is now trading at $118,786, but it's been pretty flat this week. AMBCrypto thinks BTC might squeeze out one more rally before a major correction hits between late August and early September.

The problem? Bitcoin's MVRV 365-Day Moving Average is showing the same Double-Top Camel pattern that triggered the 2021 crash. Bitcoin already formed the first peak, and the second peak is expected around September 10th.

CryptoQuant analyst Yonsei Dent agrees: "This timing aligns well with broader market narratives, such as expectations for a possible Fed rate cut and shifts in macro sentiment." He thinks the decline could even start in late August.

BTC (BTC) Holders Still Buying Despite Red Flags

Despite the warning signs, regular Bitcoin investors keep buying. In the past month, BTC holders increased their positions by 3.6% (1 week to 1 month holders) and 1.4% (1 day to 1 week holders). They've been buying between $115,252 and $117,762 – just under the current price.

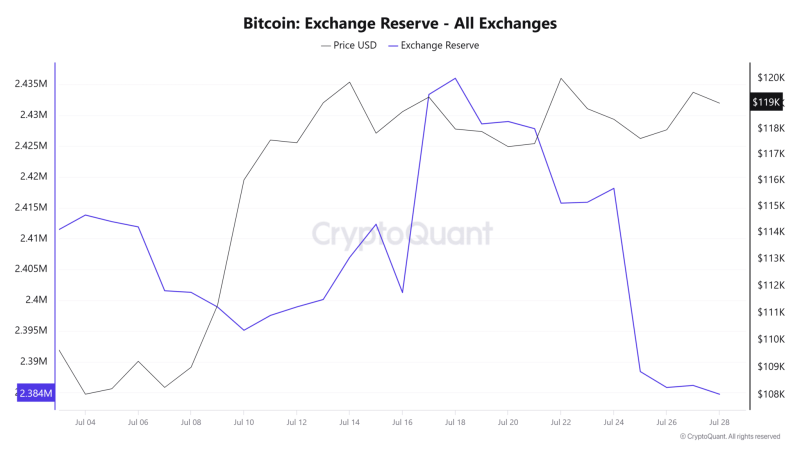

Bitcoin's Exchange Reserve also dropped to 2.3 million BTC, meaning people are moving coins off exchanges to hold long-term.

BTC (BTC) Institutions vs. Retail: Different Stories

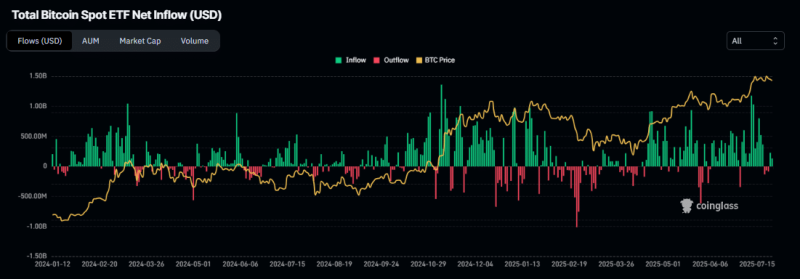

Institutions tell a different story. Between July 21st-23rd, they sold $285.2 million worth of BTC through spot ETFs. They bought back $375.5 million on July 24th-25th, but that was weak compared to recent months.

This creates an interesting split: retail investors betting on another rally while institutions seem cautious. Bitcoin could still pump more in the coming days, but the double-top pattern and institutional behavior suggest September might bring trouble. If you're holding BTC, think about your exit strategy.

Usman Salis

Usman Salis

Usman Salis

Usman Salis