After bouncing sharply from October's lows around $107,000, Bitcoin is showing clear signs of recovery. The cryptocurrency has successfully retaken the $114,000 level—a major structural zone that's now flipped to support for the first time since early September.

Technical Setup: Key Levels to Watch

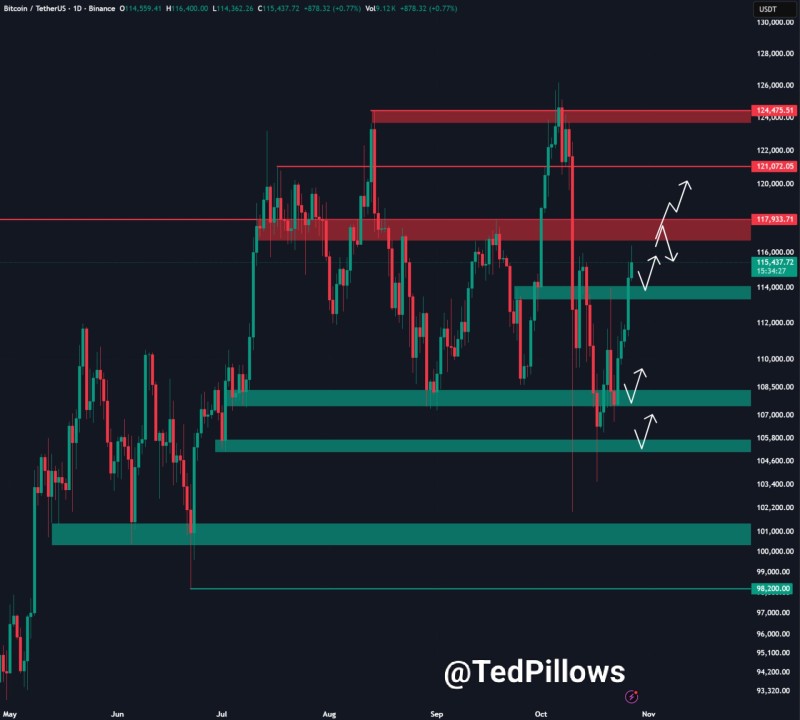

The chart shared by Ted lays out Bitcoin's current technical setup, marking demand zones in green and resistance areas in red. With BTC hovering around $115,400, bulls are building momentum for a push toward $118,000—the next critical level that could determine the near-term direction.

The daily chart shows Bitcoin rebounding strongly from the $107,000–$108,000 demand zone, confirming a higher low pattern. The recent move above $114,000 has shifted market structure in favor of buyers, with this level now acting as short-term support.

Key levels:

- Support zones: $107,000 | $108,500 | $114,000

- Resistance zones: $117,900 | $121,000 | $124,400

The $114K zone—previously a high-volume battleground—has been decisively reclaimed, signaling that buyers are regaining control. The next hurdle sits between $117,900 and $118,000, where BTC has faced rejection multiple times before.

A solid daily close above $118,000 could unlock a continuation toward $121,000, and eventually $124,400—the final barrier before new all-time highs.

Volume analysis backs the bullish case. Trading activity has picked up near $114K, pointing to strong accumulation at current levels. Each dip into the lower green zones has been met with aggressive buying—a classic sign of institutional demand forming during consolidation phases.

The pattern of higher lows since the last correction adds to the bullish structure. The symmetry in recent price waves suggests BTC could be gearing up for a larger breakout, assuming momentum holds.

Market Context

The broader backdrop remains supportive for Bitcoin. Institutional inflows through spot Bitcoin ETFs, combined with rising liquidity in risk assets, continue to fuel demand. Meanwhile, declining exchange balances suggest long-term holders are accumulating, tightening available supply during this consolidation.

Technically, Bitcoin is trading within an ascending channel, with each bounce from lower support zones leading to tests of higher resistance. If this pattern continues, a breakout above $118,000 could quickly escalate into a move toward $121K–$124K—bringing Bitcoin within striking distance of a new all-time high.

Usman Salis

Usman Salis

Usman Salis

Usman Salis