Bitcoin (BTC) risks a double top formation as it closes its lowest weekly close in four months, raising concerns about further price declines.

BTC Price Risks ‘Double Top’ Formation

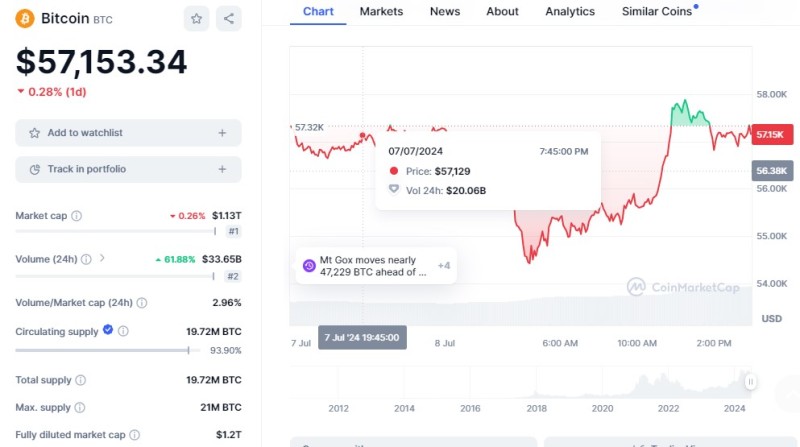

Bitcoin (BTC) enters the second week of July under significant pressure, with traders fearing further price declines. Following its lowest weekly close in four months, Bitcoin has left many bulls worried as unrealized losses continue to grow and projections suggest more pain ahead.

The trading community remains on edge, with expectations of lower levels. The current drawdown, though significant, still leaves room for BTC to drop toward—or even below—the $50,000 mark. Investors, particularly long-term holders and speculators, are bracing for how major market players will navigate the ongoing turbulence.

A combination of selling by the United States and German governments, along with the reimbursement of Bitcoin owed to creditors of the defunct exchange Mt. Gox, seems to be at the root of the current downtrend. Market sentiment reflects this, as the Crypto Fear and Greed Index has dived 60% over the past month, nearing "extreme fear."

Bitcoin Price Dynamics and Market Sentiment

Despite a brief bounce over the weekend, Bitcoin's price dropped to $54,300 at the weekly close, causing concern among traders. Popular commentator Mark Cullen described the rebound as a "dead cat bounce," predicting further declines in the coming weeks. Research firm Santiment echoed this sentiment, noting Bitcoin's poor performance alongside altcoins.

Bitcoin's price outlook remains bearish, with traders eyeing potential floor levels during this correction. $45,000 has emerged as a popular target based on previous drawdowns. Analysts like Keith Alan and Matthew Hyland are closely watching the Relative Strength Index (RSI) for signs that Bitcoin is oversold, with predictions that failing to hold current RSI levels could lead to further declines.

Recent market conditions have left a significant portion of Bitcoin investors underwater. Axel Adler Jr. from CryptoQuant highlighted the unrealized losses among short-term holder whales, warning of potential market impacts if these entities panic. The broader short-term holder base also finds itself in the red, adding to market pressures.

Macro Data and Fed Testimony to Test Bitcoin's Resilience

This week brings a slew of macroeconomic data that could further influence Bitcoin's market trends. The US Consumer Price Index (CPI) and Producer Price Index (PPI) for June are set to be released, along with testimony from Federal Reserve Chair Jerome Powell. These events are crucial as they come ahead of the Fed's next interest rate decision.

The Crypto Fear and Greed Index, now at 28/100, reflects the prevailing market pessimism, having dropped nearly 50 points in the past month. Despite Bitcoin's 25% drop from its all-time high in March, sentiment has shifted from "extreme greed" to "extreme fear." Some traders, however, like Moustache, see this as a potential bullish sign, drawing comparisons to previous market cycles where similar sentiment shifts preceded significant price recoveries.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah